Palau 2023 /AGILE REPORT/

EXECUTIVE SUMMARY

The Republic of Palau requested the IMF’s Public Financial Technical Assistance Center (PFTAC) to undertake a PEFA assessment using the AgilePEFA approach. This had been postponed previously due to the COVID-19 pandemic and the preference for the assessment to be undertaken in-country and in-person. The purpose of the PEFA assessment is to determine the performance of PFM systems and practices and their effectiveness in supporting aggregate fiscal discipline, strategic allocation of resources, and efficient service delivery. The results of the PEFA assessment will inform dialog on PFM reform interventions.

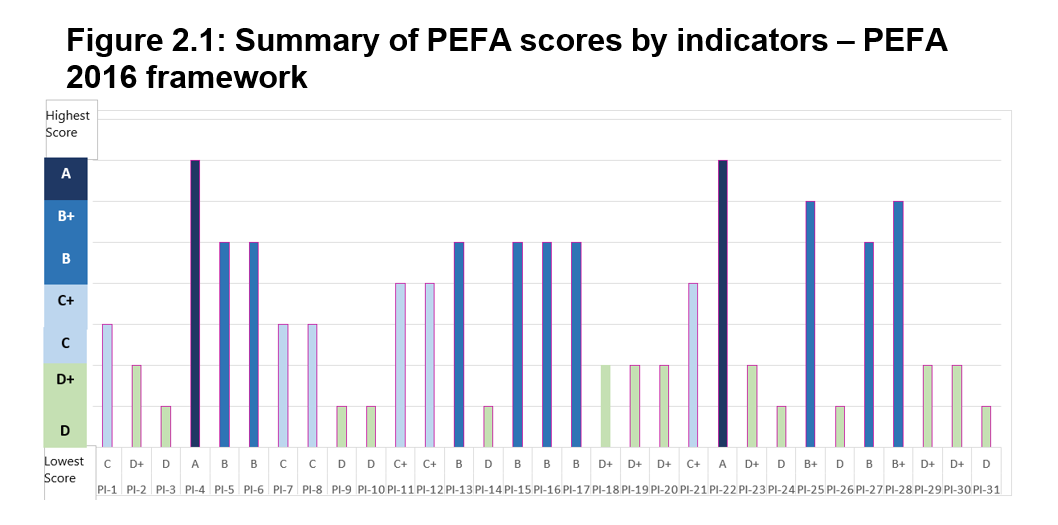

The assessment recognized sound performance in a number of areas, specifically: (i) Pillar 2 - Transparency of Public Finances; (ii) Pillar 3 - Management of Assets and Liabilities; and (iii) Pillar 4 - Policy Based Fiscal Strategy and Budgeting.

Palau has a robust budget classification (PI-4) supporting effective budget formulation, execution, and reporting, including program, administrative, and economic classifications largely aligned with international standards. Budget documentation (PI-5) provides extensive information such as macro-fiscal forecasts, allocation by function, by ministry/agency/bureau and by program, and a comparison with the previous year outturn. It also includes information on stock of debt and financial assets, as well as financial implications of new policy initiatives. Documents provide good coverage of revenues and expenditures although reporting from extrabudgetary units is somewhat delayed. Performance reports (PI-8) are produced and submitted to the OEK (Congress). On PI-11 public investment, economic analysis and project selection practices perform well – however project costing and monitoring drag overall performance under this indicator down. Public asset and debt management (PI-12 and PI-13) performed reasonably well - procedures are well defined and robust, although the rating for transparency of asset disposals was dragged down by the lateness of the consolidated annual financial reports. Performance under public access to public finances (PI-9) had some good elements with the publication of the enacted budget, in-year budget execution reports, and year-end budget execution reports. However, the executive budget proposal is not published, and the annual audited financial statements are significantly in arrears (See PI-29) impacting the overall rating for this indicator. PIs 15 to 18, Fiscal Strategy, Medium-Term Expenditure Budgeting, the budget Preparation Process all reflected sound levels of performance. Legislative scrutiny of budgets (PI-18) also had positive elements, although the procedures for the Ways and Means Committee were not provided.

Pillar 5 was somewhat of a mixed bag with good performance in some areas such as management of payables and the non-existence of expenditure arrears (PI-22), robust payroll controls (PI-23) (although undermined by a lack of payroll audits), and solid internal controls with robust segregation of duties (PIs 24 and 25). System based controls enforced through the new Financial Management Information System (FMIS) contribute to the overall internal control environment. (Also see Annex 5 for observations on internal control). Administration and Accounting for Revenue has some good elements and some elements lacking. However, it is recognized that the revenue reforms which are intended to strengthen these areas commenced after the assessment is made and further improvements can be expected in the near future.

The absence of an internal audit function combined with a lack of a payroll audit, and weaknesses in procurement impacted negatively on the overall performance of this Pillar.

Budget reliability scored relatively low, apart from the dimension relating to allocations for contingency reserve. Financial reporting reflects good practices in data integrity with timely reconciliations of bank accounts and advances, and quarterly in-year budget executions reports provide good coverage and are published on the MoF on a timely basis. However, the preparation and audit of annual financial statements are several years in arrears starting in Fiscal Year 2020. Furthermore, although the Palau Office of the Public Auditor (OPA) scored high on its independence, other areas of external audit and scrutiny scored D.

- Impact of PFM performance on three main fiscal and budgetary outcomes

- Aggregate fiscal discipline

Palau has maintained sound fiscal discipline over the years. Despite being significantly impacted by the COVID pandemic, in terms of reduced revenues during lock down as well as the necessity for spending to minimize the human impact of the pandemic, Palau has managed to constrain spending within available funding. This is evidenced by the prompt settlement of all payables and the total absence of any arears.

However, dealing with COVID has resulted in an increase in borrowing and the total debt to GDP ratio has risen to almost 92%, although as Palau emerges from the pandemic this ratio is expected to reduce.

A new FMIS was implemented in 2020 centrally within MoF, which processes transactions on behalf of the MDAs. The FMIS has assisted the strengthening of budgetary commitment controls, which has contributed to fiscal discipline, ensuring no MDA overspends its budget. Under current plans, the MoF will be rolled out to all MDAs in the medium term. This will provide full functionality to MDAs such that they will process their own transactions directly at source.

The MoF produced and published (on its website) the Economic and Fiscal Update FY2022. This sets out the economic framework of Palau over the medium-term. The Fiscal Responsibility and Debt Management Act (FRDMA) sets put the requirement to publish an Economic and Fiscal Update annually – The FY2022 Update was the first to be produced.

Palau’s principles of Fiscal Responsibility are defined in the FRDMA §105. This is based on strengthening 7 core principles – summarized in brief below:

- Managing operating expenses within operating revenues.

- Managing net capital and financial assets to achieve rising net worth.

- Managing debt prudently.

- Managing the revenue regime, to provide equitable tax-burdens, greater predictability, and increased collections.

- Managing reserves to mitigate cyclical volatility and other risks, including climate and the environment.

- Managing the broader public sector, including SOEs and Public Financial Institutions.

- Managing fiscal risks including contingent liabilities.

The passing of the FRDMA demonstrates the government’s commitment to fiscal discipline. Specifically, in regard to item (i) above, government has responded quickly (especially during COVID) to instigate prudent measures such as spending cuts in order to maintain fiscal balance.

- Strategic allocation of resources

Palau has a well- defined budget process, as evidenced in Public Law-17, and has a reasonable medium-term orientation, as evidenced in P Public Law-16. The budget call stipulates clearly that budget proposals must be aligned to national priorities in the National Master Development Plan (NMDP) as well as the Management Action Plan (MAP) including sector strategic plans. Budget proposals need to be clearly costed to determine the level of resources required. Appendix 1 of the FY22 Fiscal Update provides the Economic and Fiscal Forecasts as required under the Fiscal Responsibility Law. The fiscal forecasts for FY23-FY25 are clearly presented in the GFS format.

In preparing the FY22 budget estimates, a review of the impact of the pandemic on the FY20 and FY21 budgets was carried out in terms of tax revenues and expenditures. This exercise is built into the formulation of the FY22 estimates. However, the budget documents provide an explanation to a limited number of the changes to expenditure estimates.

Budget documents include performance information but at output rather than outcome level. All public investment projects are subjected to appropriate analysis, including need and targeted impact, which is undertaken by an inter-agency task force. A summary of this analysis is incorporated into the National Infrastructure Investment Plan (NIIP). The NIIP is also aligned to the NMDP.

- Efficient use of resources for service delivery

The Budget Act of 2001, section 371, establishes the requirements for ministries to provide performance reports. Most Ministries comply and do send their reports to the MoF. The reports do provide actual performance data but at output rather than outcome level.

Performance reports provide information on performance indicators for the budget year and on performance results for the prior year for most ministries. Performance reports include information on activities performed and evidence of measurable progress on performance targets disaggregated by program.

Information is available on the level of resources received by service delivery units within the largest Ministries, e.g., Education, Health, and Justice. Funding and performance measurement is focused on service delivery. For education there are 14 elementary schools and one high school. Funding, performance targets and performance measures are focused on the schools and the students attending those schools. Similarly, for Health, eight community health centers and several specialty clinics provide health services. Funding, performance objectives and performance reporting are focused on clinics and patients. Performance objectives and measurement of results are targeted on the service providers and the intended beneficiaries.

However, no performance audits are performed, and there is scope for improvement in costing, monitoring, and evaluation of major investment projects.

Performance change since previous assessment

No comparison is made with the previous 2013 PEFA assessment as the ratings were not firm and some of the dimensions were not assessed in strict accordance with the 2011 methodology—for example tax and customs revenue administration were assessed individually.

Progress in Government PFM reform program

The enactment of the FRDMA has contributed to PFM progress (See the 7 core principles of the Act above). Probably the single largest reform is the intervention to implement the PGST. It is envisaged that the PGST will achieve revenue gains of 1% of GDP, as well as promoting a more transparent and equitable tax regime. This reform went live 1st January 2023.

Whilst no direct comparison is made with the 2013 self-assessment, it is evident that there have been improvements in PFM performance in many areas. These have been achieved in part through continual attention to capacity development, as well as strengthening systems support through the implementation of the FMIS. However, rollout of the full FMIS functionality and on-site access to the MDAs is still ongoing.

The Bureau of Customs and Border Protection (BCBP) is piloting the implementation of the Automated System for Customs Data (ASYCUDA), and once this is rolled out it will facilitate and streamline the processes for importers.