Nepal 2024

Executive Summary

Purpose and management

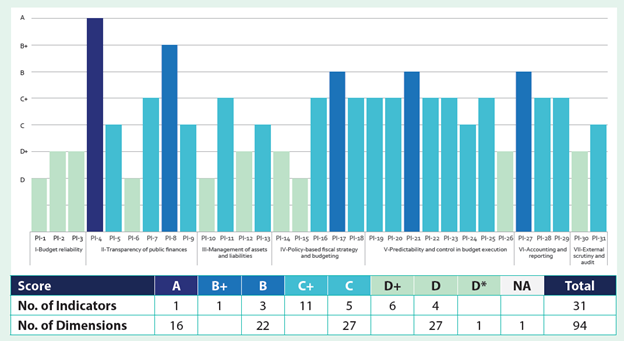

This report provides an in-depth analysis of Nepal’s PFM systems based on the 2016 Public Expenditure and Financial Accountability (PEFA) assessment methodology. The assessment includes 31 performance indicators (PIs) (and associated dimensions), classified into seven critical pillars of performance, to capture a snapshot of the government’s public financial management (PFM) systems, processes, and institutions. The assessment, based on the 2016 methodology, was undertaken by the Government of Nepal (GoN) as a self-assessment with technical support from the World Bank. At the same time, a Climate-Responsive Public Financial Management (CRPFM) assessment and a Gender-Responsive Public Financial Management (GRPFM) assessment have also been undertaken as self-assessments with technical support from the World Bank, based on the respective PEFA Frameworks. The CRPFM and GRPFM assessments are published as separate reports. These assessments were co-financed by the Nepal PFM Multi-Donor Trust Fund (MDTF).

The GoN has implemented PFM reforms since 1990s. Initially, the government made interventions at the thematic and institutional levels. After the first PEFA Assessment in 2008, the government has adopted a strategy of utilizing the outcomes of the PEFA Assessments as the foundation for its PFM reforms. Since 2008, the reforms have been guided by a PFM Reform Strategy, and the second phase of the strategy, spanning from FY2016/17 to FY2025/26, is under implementation. Several achievements have been accomplished under the PFM Reform Strategy. Implementation of information systems for budgeting, expenditure, reporting, and revenue administration has instituted fiscal discipline and financial efficiency. The Treasury Single Account (TSA) has been implemented that facilitates better cash management. The enactment of updated PFM legislation has brought more transparency and a results-oriented approach to the PFM process in all three tiers of government. Nepal has adopted international standards for accounting and auditing to improve the quality of financial reporting and auditing.

The primary objectives of the assessment are to establish a baseline for future assessments, compare the level of change in performance to previous assessments, and provide a credible foundation for the next PFM Reform Strategy. This assessment will help gain a better understanding of the PFM environment and identify areas that require further development and reform. The assessment results will serve as a basis for updating the PFM Reform Strategy for the harmonization of the reform initiatives by the government and the development partners.

Main strengths and weaknesses of the PFM systems in Nepal

Nepal possesses a robust legislative and institutional framework for PFM, which effectively regulates the utilization of public resources with a focus on transparency, accountability, and efficiency. The framework additionally incorporates explicit delineations of tasks and responsibilities for various governmental entities. The government has deployed a range of information systems to enhance the efficiency of PFM performance. The adherence to international standards (Government Finance Statistics Manual [GFSM] and Classification of the Functions of Government [COFOG]) in the budget and accounts classification ensures comparability, accuracy, comprehensiveness, and transparency in financial information. Budgets are designed with a medium-term outlook, and the majority of line ministries have developed costed sector strategies. The predictability of resource availability for spending units is at a high level. During the assessment period, the Ministry of Finance (MoF) did not initiate any in-year budget modifications, and the utilization of contingency reserves for expenditure was minimal. The fiscal transfers allocated to subnational governments exhibit transparency and adherence to established rules. The scope and coverage of both the internal and external audit are extensive.

Despite the presence of conducive conditions, the actual budget outcomes exhibit a notable degree of underperformance. One of the primary factors contributing to this issue is the ambitiousness in macroeconomic and fiscal projections, coupled with overly optimistic budgeting, and the absence of a coordinated fiscal strategy. There is currently a lack of a dependable database for monitoring procurement activities, and the procurement planning process is not sufficiently robust. The expenditure units fail to fulfill a substantial portion of their scheduled procurements within the designated time frame, leading to a reduction in the budget outturn. The existing system for monitoring public investments and fiscal outcomes has been established; nevertheless, the current reporting lacks comprehensive explanations of discrepancies and corresponding measures to rectify them. The specified framework for fiscal risk reporting and monitoring exists; however, there is a lack of documentation to substantiate the implementation of fiscal risk reporting and monitoring. Revenue entities employ a partially structured and systematic methodology to evaluate and prioritize compliance risks and are yet to develop compliance improvement plans. The examination of audit reports by the legislative body has experienced delays, resulting in the Public Accounts Committee (PAC) being unable to fully review the audit report for any fiscal year over the past three years.

Impact of PFM performance on budgetary and fiscal outcomes

The results of the current PEFA Assessment are presented to explain how the PFM performance in Nepal has influenced the three fiscal and budgetary outcomes—aggregate fiscal discipline, strategic allocation of resources, and efficiency in service delivery.

Aggregate fiscal discipline

The GoN has demonstrated ability to control expenditure and prevent unexpected deficits, but there is still room for improvement when it comes to budget outturns. During the assessment period, the aggregate expenditure outturn was below 85 percent and the aggregate revenue outturn was below 92 percent. A combination of factors, including the COVID-19 pandemic, execution of a significant portion of the federal budget by subnational governments, inefficiencies in procurement, weaknesses in project appraisal, and ambitious budget estimates have all affected the budget outturns.

During the fiscal years affected by COVID-19, the government estimated higher economic and revenue growth, which is the main reason for lower revenue outturn. Although there is a higher predictability in the availability of resources, the spending units are still unable to execute a large portion of the approved budget. This issue is amplified for the development budget, where around 40 percent of the annual budget remains unspent. The MoF does not instigate any in-year budget adjustments, the expenditure charged to the contingency vote is almost 0 percent, and the total budget has been available for spending since the start of the fiscal year. Despite having an enabling environment, the lower budget outturns highlight the lower spending capacity of the budgetary units.

The prescribed internal control framework is detailed, and compliance rates are consistently high. The legal and regulatory framework mandates rigorous internal controls that have been integrated into the information systems used for expenditure management. According to both internal and external audit reports, the percentage of non-compliant expenditures is less than 5 percent, indicating a strong adherence to the prescribed controls. While the internal audit system has been institutionalized under the Financial Comptroller General Office (FCGO), there is room for improvement in terms of its focus. Currently, the internal audit system’s primary focus is on financial compliance, lacking a risk-based approach that could address system strengthening.

Strategic allocation of resources

The PFM system modestly supports the attainment of allocative efficiency by strategically planning and effectively utilizing budgetary resources in accordance with the GoN’s goals and policy objectives. The directive principles of the Constitution, the SDG framework, and the periodic plan provide the long-term framework for strategic allocation of resources. Sectoral strategies of the ministries and the Medium-Term Expenditure Framework (MTEF) offer the bases for medium-term perspectives of the resource allocation. To effectively allocate resources in a strategic manner, the PFM system incorporates various components. These include a robust system for classifying budgets, the provision of comprehensive information on public finances, the implementation of transparent and rule-based fiscal transfers to subnational governments, adherence to a clearly defined budget calendar, efficient revenue administration, and the availability of reliable financial data for the preparation of periodic budget execution reports and annual financial statements.

The deficiencies in macroeconomic forecasting and limitations in public investment management hinder the strategic allocation of resources. The MTEF lacks standardized modeling techniques for fiscal forecasting and delivering comprehensive projections for future years. In addition, an integrated fiscal strategy has not been developed to accurately estimate the fiscal consequences of revenue and expenditure policy proposals at the level of individual policies.

The inadequate implementation of contemporary budgeting procedures hampers the effectiveness of resource allocation. The budget allocation system predominantly follows an incremental approach, while the budget estimation for both recurrent and development budgets is characterized by fragmentation. Consequently, this hinders the establishment of strong connections between the chosen programs and policy priorities. The effectiveness of public investments is hampered by quality of data and analysis for project appraisal and monitoring. Significant allocations of resources have been dedicated to projects that exhibit inadequate preparation and have not undergone proper processing as per the Public Investment Management (PIM) Framework. The National Planning Commission (NPC) has issued Project Bank Guidelines to rectify the deficiencies in the current PIM Framework. However, the execution would require a considerable amount of time, and the outcomes would gradually accumulate over the medium term.

Efficient use of resources for service delivery

The performance of the PFM system is notable at supporting the delivery of public services. Several variables contribute to the facilitation of efficient service delivery. Following federalization, a significant portion of service delivery responsibilities has been decentralized to subnational governments. The fiscal transfers to subnational governments are allocated based on criteria that are both transparent and guided by established regulations. The budget documents included key performance indicators and the anticipated output for most of the programs or services delivered by the line ministries. Furthermore, the yearly progress reports provide updates on the extent to which these targets have been achieved. The spending units have access to up-to-date information regarding annual grants, and the reliability of resource availability throughout the year is high, guaranteeing the availability of resources at the required times. Regular internal audits are undertaken to ensure compliance, while the Office of the Auditor General (OAGN) conducts annual financial and performance audits to detect inefficiencies in program implementation and service delivery.

The achievement of service delivery targets is hindered by the restricted capacity of spending units to effectively utilize funds, despite a conducive environment that incorporates performance information into budgeting and ensures the availability of resources. The planning quality is deemed less than optimal, mostly due to a heavy reliance on an incremental approach for recurrent budgets and a deficiency in conducting thorough appraisals for investment projects. The annual procurement plans, despite being a regulatory necessity, are often subject to delays in preparation or lack of updates. The initiation of procurements occurs later in the fiscal year, and the procurement process is characterized by a leisurely pace and a reliance on a competitive approach based on the selection of the lowest bid. The issue of excessive staff turnover and insufficient staffing capacity exacerbates the existing issues. The aforementioned challenges have led to substantial delays in the budget execution, affecting efficient service delivery.

Summary of the performance changes since 2015 assessment

The PFM performance has exhibited improvement between the 2015 and 2022 assessments, as observed through the lens of the PEFA 2011 Framework. There was an improvement in the scores of 30 dimensions, a deterioration in the scores of 10 dimensions, and no change in the ratings of 31 dimensions. Nevertheless, despite the enhancements observed in the dimension scores, there was no corresponding improvement in the indicator scores. Specifically, out of the total of 28 indicators, the scores of 6 indicators improved, 7 experienced a decline in scores, while 15 indicators remained the same.

The transparency of intergovernmental fiscal relations has been enhanced by the implementation of transparent and rule-based fiscal transfers. The scope of unreported government operations has improved as a result of the rise in on-budget development assistance. Various line ministries have developed costed sector strategies that align with the MTEF, improving the multi-year perspective in budgeting. Taxpayer registration and tax collection transfer to the treasury have shown notable enhancements in efficacy. Other areas that have improved include debt management, internal audit coverage and reporting, compliance with internal controls, financial statement accuracy, and legislative scrutiny applied to budget and audit reports.

The budget credibility has declined over the years as the variance between budgeted and actual expenditure and revenues increased both at the aggregate level and by composition. This led to a decrease in the scores of three indicators. The new PFM regulations now require spending units to submit their budget estimates within four weeks, which is a reduction from the previous six weeks’ allowance for submission. In the past, the MTEF used to categorize expenditures based on economic and functional classifications for the subsequent two fiscal years. However, the current MTEF provides expenditure estimates categorized into recurrent, capital, and financial provisions. Some areas of performance remained unchanged, but scores deteriorated due to anticipatory scoring of some dimensions and indicators during the previous assessment. For instance, the 2015 assessment considered the cash plan developed using quarterly budget projections from the spending units, equivalent to a cash flow statement.