Nauru 2022 /AGILE REPORT/

Oversight and management

In response to a request from the Government of Nauru, the IMF Pacific Financial Technical Assistance Center (PFTAC) coordinated and funded this Agile PEFA and Gender Responsive Assessment. The assessment is a joint effort between the Oversight Team and the Assessment Team.

The assessment was supported by the Oversight Team led by Ms. Novena Itsimaera, Secretary for Finance and Chairperson; and included Mr Isikeli Voceduadua - Deputy Financial Secretary; Mr Atunaisa Baleimatuku - Chief Accountant; Ms Stephanie Tebouwa - Director Budget; and Mr Rosco Cain - Director of Planning.

The assessment team was led by Mr. Iulai Lavea (PFM Advisor; PFTAC) and included Mr. Paul Seeds (PFM Advisor; PFTAC); Mr. Matt Crooke (PFTAC Expert); Mr Paula Uluinaceva (PFTAC Expert); Mr Iain Rennie (ADB Rep), Ms. Esther-Lameko Poutoa and Mr. Tiofilusi Tiueti (PASAI) and Ms Kelera Ravono – representative of the Ministry for Economy, Government of Fiji.

The Peer Reviewers include representatives of the Government of Nauru, PEFA Secretariat, Department of Foreign Affairs & Trade, Australia (Mathew Harding), Ministry of Foreign Affairs & Trade, NZ (Christine van Hooft), ADB (Prince Christian Cruz) and the IMF (Gemma Preston; Guohua Huang).

Further details on the assessment management and quality assurance arrangements are presented in Annex 1.

The 2016 PEFA Self-Assessment concluded that overall, there had been notable improvements in a number of indicators since the 2010 PEFA assessment.

Drawing on the results of the 2016 Self-Assessment, the GoN developed a PFM Roadmap targeting improvements in the budget process as the top priority. These include developing a comprehensive medium term fiscal framework (MTFF), developing macro-fiscal sensitivity analysis to form part of the budget document, revising budget classification and the chart of accounts to be GFS-compliant at a basic level, including actuals in budget documents, and establishing greater linkages between annual operational plans (AOP), the budget and annual reports, as well as publishing unaudited financial statements.

The 2022 assessment documents good progress in debt management, participation in the budget preparation process, having a clear fiscal strategy, timeliness of in-year budget reports, internal controls for non-salary expenditures, cash flow and revenue management, and transparency of budget information. On the other hand, weaknesses remain evident in external scrutiny, audit and annual financial reporting, procurement management, internal audit, bank reconciliation and asset management,

Nauru has demonstrated real commitment to better managing its economy despite the highly uncertain environment it faces. The fiscal outturn continues to improve, having achieved surpluses over the past three years when most Pacific economies struggled to manage successively larger budget deficits. Nauru has successfully attained the fiscal responsibility ratios in each of the past three years. During COVID, Nauru performed exceptionally well registering positive growth when most economies slowed down or contracted. Government spending continues to stay within the revenue envelope.

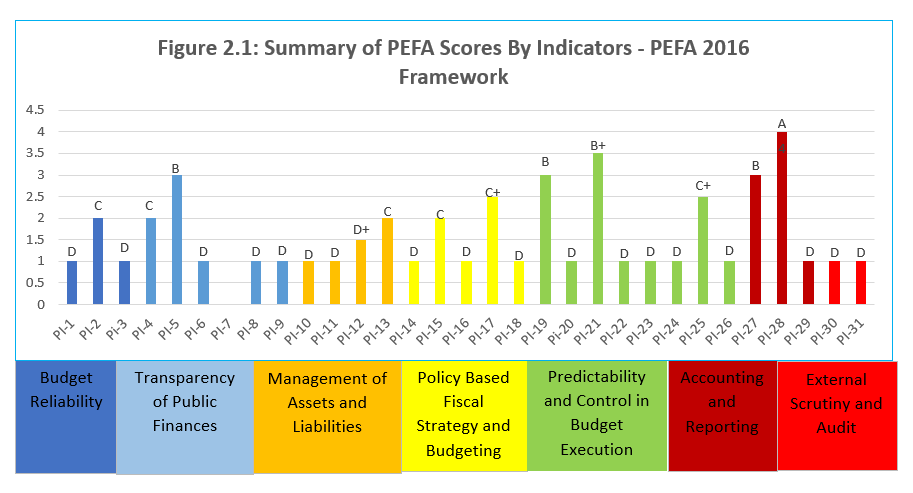

Table 2.1 provides a snapshot of the PEFA dimensions and indicator ratings. These ratings are based on the guidance provided in the PEFA Handbook Volume II: PEFA Assessment Field Guide. The ratings are definitive to specific aspects of PFM based on data and evidence supplied by the authorities. The preliminary scores were shared with the authorities and the additional data/evidence provided post meeting was useful to further clarify what is currently taking place on the ground.

Using the PEFA guidelines, the results show that 32% of the indicators perform above average with 68% below average. Nevertheless, it is clear the government has invested heavily in making sure fiscal sustainability is maintained and that service delivery for the benefit of the community continues to improve.

On Budget Reliability (Pillar One), despite some limited progress, many challenges remain. Most notably, there is considerable uncertainty surrounding revenues, including grants, and government consequently takes a conservative approach to forecasting. This then manifests in conservative expenditure estimates. Estimates are updated through the year via supplementary appropriations as additional revenues are identified, accommodating additional spending. Government is looking to reform this practice by implementing a single supplementary budget linked to a mid-year budget review.

On Transparency of Public Finances (Pillar Two), some elements demonstrated good performance, namely the chart of accounts and transparency of budget documentation. However, the budget classification provides comprehensive coverage for reporting purposes but does not align to GFSM2014 standards. Performance fared less well on public access to fiscal information, primarily due to the infrequency of published information, coverage of operations in financial reports, and performance information for service delivery.

Regarding Management of Assets and Liabilities (Pillar 3), public enterprise reform is ongoing supported by the new Public Enterprise Act 2019. Performance on public investment management is bolstered by involvement of development partners in appraising project proposals. However, weaknesses remain in fiscal risk reporting, public investment and public asset management. Although there is currently no debt management strategy, an annual debt report is now produced, and the Government Loans Act provides a foundation for approval of loans and guarantees.

Policy-Based Fiscal Strategy and Budgeting (Pillar Four) scored reasonably well in terms of the budget process and work has been ongoing with development partners on the National Infrastructure Investment Strategic Plan, leading to a better costed and prioritized investment pipeline. However, practices focus largely on the annual budget with limited attention toward multi-year costing and estimation. Binding medium term ceilings are undermined by the uncertainty of revenues. Furthermore, government does not undertake any internal economic forecasts but relies on IMF’s World Economic Outlook (WEO) estimates, which are not updated alongside budget revisions.

For Predictability and Control in Budget Execution (Pillar Five), revenue administration and accounting practices perform well, with well-defined rights and obligations and minimal revenue arrears. Banking arrangements are straightforward and commitment ceilings (warrants) are received in full at the start of the year. However, predictability is undermined by the lack of forward-looking cash flow forecasting. Internal controls for non-salary expenditures are solid but weakness prevail in risk management and audit of revenues; payroll controls; and procurement. Whilst expenditure arrears are minimal, this is a product of vendors requiring upfront payment rather than effective commitment and payment controls. Furthermore, there is no internal audit function.

Accounting and Reporting (Pillar Six) reflect good performance on data integrity and in-year budget reports significantly attributable to the FMIS and good Treasury capacity. However, annual financial reporting suffers from a significant historic backlog which needs to be cleared before more current annual statements can be finalized.

External Scrutiny and Audit (Pillar Seven) is impacted by the backlog of annual financial statements built up in the past, resulting in delays in completing audits and tabling to Parliament. Audits are not undertaken in accordance with international audit standards, and recommendations are not followed up. The SAI is not independent of the executive government, as the appointment of the Auditor General is made by the Chief Secretary.

Impact of PFM performance on three main fiscal and budgetary outcomes

The main objective of PEFA and PFM reform is to support sustainable development and better and more effective service delivery outcomes that meet community needs and priorities. Progress is measured through the contribution of PFM systems and processes to the following three main fiscal and budgetary outcomes.

1. Aggregate fiscal discipline

Over the three fiscal years under review, the government continued to emphasize fiscal sustainability as the key budget strategy. Achieving budget surplus remained the key outcome that cannot be compromised. The Nauru budget depends largely on RPC activities and fisheries for revenue generation. The fiscal scenarios supporting the budget focus on these key drivers. Nauru’s budget takes a single-year horizon largely due to the significant uncertainty around revenue sources. Original revenue estimates take a conservative position with the flexibility to increase spending in the event additional revenue get realized during the course of the budget year. Increased spending is cleared by Parliament through supplementary budgets but cannot exceed the total revenue envelope.

2. Strategic allocation of resources

The National Sustainable Development Strategy 2019-2030 (NSDS) articulates Nauru’s broad national priorities and vision going forward. It provides the framework for resource allocation and guides the formulation of ministry Annual Operational Plans (AOP). At the sector level, plans such as the Integrated Infrastructure Strategic Plan (NIISP), the Nauru Health Strategy (NHS) 2021-25, and the Footpath IV Strategic Plan (FPIV) 2017-21 for education also provide valuable information to budget planning and formulation. There are strong linkages between the sector strategies and the NSDS priorities. New projects are required to clearly establish its linkage to sectoral and national priorities. Overall, all ministries prepare their AOPs based on the sector strategies and link them to the NSDS priorities.

3. Efficient use of resources for service delivery

The Government remains committed to fiscal responsibility and maintaining macro-economic stability and prioritizing investments in education, health and medical care, infrastructure, food security, water supply and housing. Resource allocation reflects these priorities not only to ensure the community receives the services they demand but also to build resilience to cushion the adverse impact of external shocks.

The Ministry Annual Operational Plans (AOPs) are aligned to the national strategies in the NSDS as well as the budget priorities which are mutually complementary. The development of AOPs has been a very positive development in strengthening the linkages between the national objectives and resource allocation promoting policy consistency in the budget and planning process. For FY2019, a total of $29.5m accounting for 15% of total expenditures was spent on education and health.

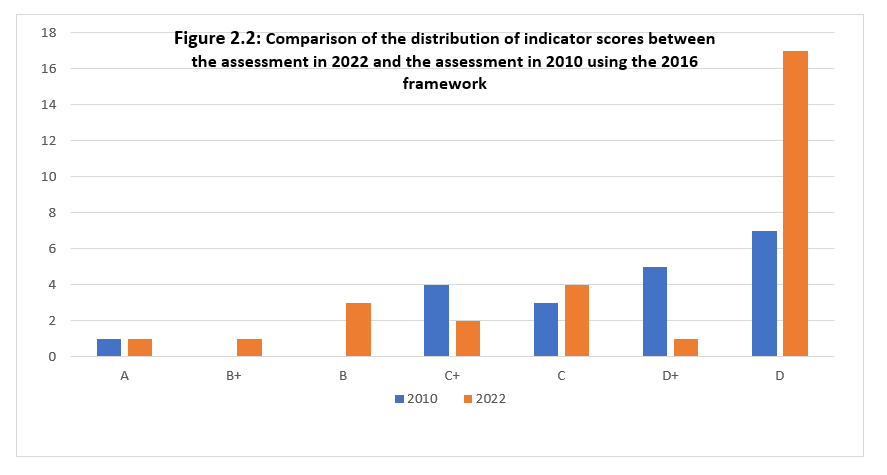

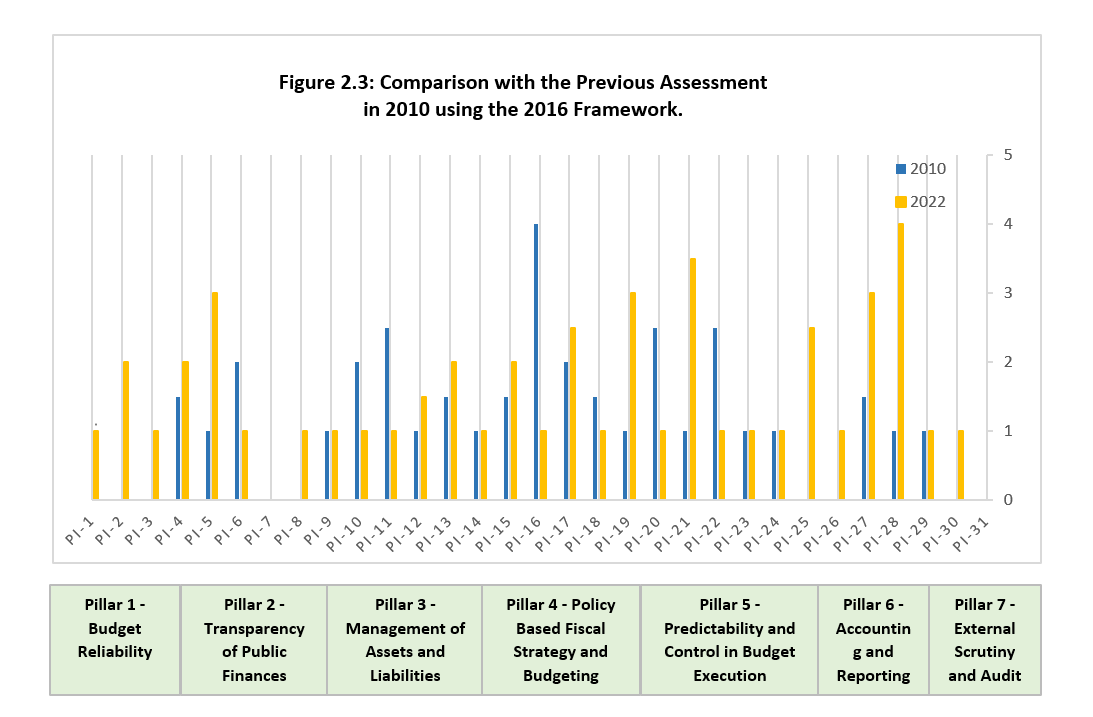

Performance change since previous assessment

The initial Nauru PEFA assessment conducted in 2010 concluded that Nauru’s PFM systems and processes were not well developed and many areas were identified for follow-up action. The Self-Assessment conducted in 2016 highlighted significant progress in the areas of expenditure management, budget preparation, accounting for revenue, internal controls on non-salary expenditures, and availability of in-year budget reports.

Drawing on the results of the Self-Assessment, a PFM Roadmap was designed and implemented. The GoN implemented a number of reform initiatives resulting in positive progress in many PFM areas. The 2022 PEFA and Gender Responsive assessment has realized significant improvements both at the policy and the activity level in particular the PFM space. Debt management, participation in the budget preparation process, having a clear fiscal strategy and ability to assess the fiscal impact of revenue and expenditure policy proposals, timeliness of in-year budget reports; internal controls for non-salary expenditures; cash flow and revenue management, and transparency of budget information recorded high scores. Gender responsiveness is not well developed and this is to be expected given this is the first time gender issues have been assessed.

Progress in Government PFM reform program

GoN has invested heavily in PFM reforms. The risk posed by the uncertainty of RPC operations which are the key economic driver underscores the need for prudent fiscal management. During the past three fiscal years, GoN has demonstrated real commitment to maintaining fiscal sustainability underpinned by a number of PFM reforms. These include at the policy level:

- The push to maintain macroeconomic stability premised on targeting quality spending that reflects national priorities and realistic estimates of expected revenues and expenditures;

- Prioritized investment in infrastructure, linked to the priorities identified in the Nauru Integrated Infrastructure Strategic Plan (NIISP), and

- Improved efficiency and effectiveness in SOE operations.

Macroeconomic stability is supported through responsible budget management by the achievement of the three fiscal responsibility ratios which are:

- Achievement of budget balance;

- Limiting personnel expenses as a proportion of current expenditure to below 30%; and

- Establishing fiscal cash buffer of three months adjusted non-RPC expenditure.

Managing government debt in a sustainable manner is another key reform initiative to ensure that the financing needs of government are met on a timely basis; and that borrowing costs are as low as possible and consistent with a prudent degree of risk.