Tajikistan 2022

Executive Summary

Purpose and management

1. The purpose of the assessment is to review the changes in Tajikistan’s Public Finance Management (PFM) system performance since the last PEFA assessment that was carried out in 2017 and to provide the MoF with an objective and up-to-date assessment of current performance of Tajikistan’s PFM system. The 2021 PEFA Assessment Report is the second assessment that is based on the 2016 PEFA Framework and provides a renewed baseline for strategic policy actions and reform implementation in PFM.

2. The main motivation for undertaking the 2021 PEFA assessment, which was formally requested by the Ministry of Finance (MoF) of the Republic of Tajikistan, is twofold: (i) to establish a baseline of policy reforms vis-a-vis the PFM Reform Strategy (PFMRS) of the Republic of Tajikistan for the period until 2030 and its mid-term operational framework; and (ii) to identify gaps and challenges in PFM system which could serve as potential entry points for future technical assistance interventions by development partners.

3. The 2021 PEFA assessment will be used to inform adjustments in the programmatic approach to PFM reform in Tajikistan. The findings of the PEFA assessment are important inputs into further implementation of PFMRS and the corresponding three-year action plan. Comparison of results from the 2021 PEFA assessment with the previous assessment (completed in 2017) will also represent a measure of progress with regards to PFM reform in Tajikistan.

4.The lead agencies of the 2021 PEFA assessment are the MoF on behalf of the Government of the Republic of Tajikistan (GoRT) and the Swiss Government represented by State Secretariat for Economic Affairs (SECO). The assessment is managed by the SECO through the Lucerne University of Applied Sciences and Arts (HSLU) and the Zurich University of Applied Science (ZHAW), and is undertaken by national PFM experts representing IRSHAD Consulting. The lead agencies have also established an oversight team that ensures overall guidance on the assessment process and peer reviews the draft and final 2021 PEFA Assessment Report, and includes the SECO, the MoF, the World Bank (WB), and the International Monetary Fund (IMF).

Scope, coverage, and timing

5. Similar to previous assessments, the 2021 PEFA assessment focuses on the national (i.e. central government) level of the country’s PFM system. At the national level, it covers the entire PFM system, including cross-cutting and overall issues: the revenue side, the budget cycle from planning through execution to control and auditing; and the interaction of development partners with the PFM system. None of the additional PEFA Modules (e.g. service delivery, gender, climate, subnational) was applied.

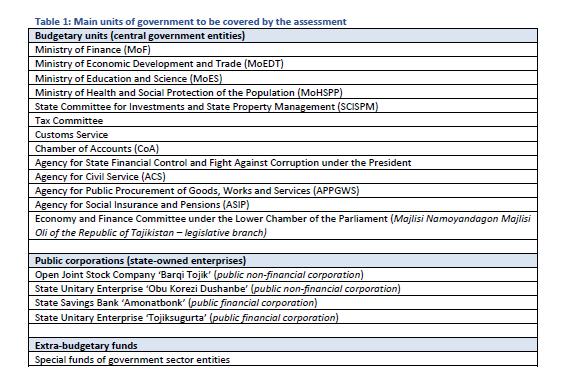

6. The central government entities covered by the assessment are listed in Table 1, which includes the Parliamentary Budget Committee (representing the legislative branch) and the Chamber of Accounts (an equivalent of Tajikistan’s supreme audit institution). The assessment also includes several financial and non-financial public corporations and special funds of government sector entities (i.e. own revenues generated by government sector entities, which are regarded as extrabudgetary funds in line with the IMF’s 2014 Government Finance Statistics). The large number of central government entities reflects the requirement to triangulate data from multiple sources.

7. The assessment focuses on PFM performance looking at the last three years, namely 2018-2020 (i.e. the reference years). The cut-off date was December 17, 2021 in line with the implementation timetable. Due to significant fiscal consolidation measures and other policy constraints caused by the COVID-19 pandemic, the oversight team recognizes that 2020 may be regarded as an outlier year, possibly affecting some PFM outturns. For example, unforeseen revenue shortfall resulted in larger-than-expected deviation of budget outturns against original allocations, and fiscal risks exacerbated due to weaker financial performance of budgetary units. The budget preparation process was briefly disrupted due to restrictions that were briefly imposed by the government in May-August. Audit planning and procurement planning were also negatively affected by the pandemic-induced risks, and fiscal consolidation measures were put in place.

8. Depending on PEFA requirements, the assessment under an indicator may be concerned with the current status of PFM or performance over the last completed fiscal year (2020), or performance over the last three completed fiscal years (2018-2020).

Impact of PFM on budgetary and fiscal outcomes

9. The ability of the national PFM system in Tajikistan to provide relevant information on status of, and risk to, debt and deficits is its most significant contribution. For efficient allocation of resources, a PFM system that focuses on providing relevant information on available resources, and a timely budget preparation process that is inclusive and transparent, is likely to contribute to the right allocation. The government-led PFM strategy, which has been put in place in January 2020, contributes to further improving the PFM outcomes in Tajikistan.

10. Tajikistan has also been hit by the COVID-19 pandemic, which interrupted the government’s mid-term development plans. The pandemic imposed substantial costs on the economy and the budget, and highlighted the substantial fiscal and structural challenges that the country faces.

11. In this context, improved effectiveness and efficiency of spending requires strengthened PFM. The main areas of improvement include better budget planning, sustained treasury and accounting reforms, improvements in public procurement, and measures to mitigate fiscal risks.

Macro-fiscal discipline

12. Robust medium-term fiscal planning has significantly improved but remains challenging in the presence of potential new borrowings by the government, fragility of Tajikistan’s economy to external disturbances and shocks, and economic uncertainty. Improved debt management and assessment of fiscal risks would also support greater fiscal discipline.

Strategic allocation of resources

13. With the objective to strategically allocate limited resources, the GoRT is developing sector plans, strategies and programs. Assumingly, they will be appropriately linked to public resources, such as through the medium-term expenditure framework. However, it does not appear that the principles of policy-based budgeting are fully in place across the government sector. A performance culture needs to be built which will examine critically the use of manpower, and require public sector managers to be accountable for the results of the expenditures under their control.

Operational efficiency

14. Persistent in-year changes in government expenditure and weak oversight function in medium-term expenditure planning may be seen as evidence that expenditure control should be strengthened. Some of the changes in recent years - improvements in the content and timeliness of budget execution reporting, improvements in the transparency of public procurement – should help to create conditions in which inefficiency can more effectively be challenged. Further development of internal and external audit functions and practices should shed more light on the scope for improvement. But much remains to be done. Effective internal financial control arrangements need to be instituted throughout the government, and management and control of the public sector payroll should be enhanced.

15. Compared to the previous assessment, 10 out of 31 performance indicators showed improvement, and 7 out of 31 performance indicators demonstrated deterioration. Nearly half of all performance indicators, i.e. 14 out of 31, did not change in comparison with the previous PEFA assessment in 2017.