North Macedonia 2022

Executive Summary

Purpose and management

This PEFA assessment provides a snapshot of the country’s PFM system performance in order to support the government in defining PFM reform priorities. The previous assessment was conducted in 2015, therefore the current assessment follows after the recommended time period between the two assessments. Furthermore, the scope and objectives of the reforms initiated and implemented in the intervening period makes tracking the change in the PFM system needed and meaningful. The assessment was conducted by the International Monetary Fund and the World Bank, with the Ministry of Finance and other relevant country institutions being the primary beneficiaries of the assessment.

The assessment informed evaluation of the implementation of the PFM Reform Program 2018-2021, and preparation of a new reform program. The Public Financial Management Reform Program (PFMRP) is the key strategic document in the area of public financial management, which describes the planned reforms and set targets and indicators to measure implementation results. The Government completed the implementation of the PFMRP covering the period 2018-2021 and is in the process of preparation of a new program. A number of reforms have been implemented under the PFMRP 2018-2021, but the assessment identified further remaining areas for improvement. The assessment aims to inform the Government about the performance of its PFM system in line with the PEFA methodology, as well as to track the changes between the 2015 assessment and the current one.

Main strengths and weaknesses of the PFM systems in the Republic of North Macedonia The assessment has identified the following main strengths of the country’s PFM system:

✓ Budget formulation, credibility and transparency. Deviations of the executed versus the original budget are within manageable levels, with the exception on the revenue side in 2020 due to the pandemic. Deviation in the composition of expenditure and revenue is more significant, and it includes reallocations from capital to recurrent budget coupled with the capital budget underspending. Annual budget and budget execution reports are presented in line with all relevant classifications, namely administrative, economic, functional and program classification, while in-year reporting does not provide all classifications and tends to be more aggregated. However, the comprehensiveness of the published budget documentation provided to the legislature could be improved as some key elements are missing, such as current year’s budget, aggregated budget data for revenue and expenditures, macroeconomic assumptions, information on financial assets, budgetary impact of new policy proposals and assessments of fiscal risks and tax expenditures. Fiscal information is transparent and publicly accessible. Transfers to lower levels of government are based on a rule-based, transparent and equitable system. Budget calendar is appropriate and generally adhered to, however the ceilings provided to budget users do not cover the total expenditures for which they are responsible.

✓ Budget execution. Predictability of available funds for budget execution during the year is robust and underpinned by suitable cash flow forecasting and monitoring. There are hard controls at the payments stage which ensure that the budget is executed within the approved allocations and against quarterly commitment ceilings. Available records on expenditure arrears report low stock of arrears. Internal controls, including payroll controls, are generally sound. Public procurement is competitive, transparent, with appropriate complaints mechanism in place.

✓ External audit and parliamentary scrutiny. The State Audit Office (SAO) is financially and organizationally independent and it conducts audits in line with its annual audit plan and international standards, while the number of audited entities and the audit coverage beyond statutory audits is dictated by the institution’s capacity. Nonetheless, the SAO audits central government’s budget execution report annually and in a timely manner (3-4 months after receiving the financial statements, with the exception in 2020 due to the pandemic) and the resulting audit report is published. There is effective follow-up of audit recommendations by the auditees. Procedures and practices for the parliament’s review of the annual budget are appropriate in terms of scope and timeliness, while the scrutiny of the audit reports is also timely (within three months) and transparent, although public hearings and recommendations based on audit reports are insufficient.

✓ Debt management. Recording and reporting of debt and guarantees are overall adequate, and monthly reconciliation with creditors should be within reach considering the overall level of performance. The Ministry of Finance is the single entity in charge of approving government borrowing. There is a three-year debt management strategy whose implementation against the debt management objectives and indicators is monitored and publicly reported.

The following were assessed as areas for continued reforms and further improvements:

➢ Medium-term perspective in planning and budgeting. While budget documentation includes expenditure estimates and ceilings for two years following the budget year, analysis of deviations from such estimates and ceilings in the next budget cycle, and related explanations are not provided, reducing the effectiveness of the medium-term targets. A three-year Fiscal Strategy is adopted; however it does not include quantification of the fiscal impact of policy proposals, explanations of proposed changes in revenues and expenditures over the threeyear period, nor is implementation progress towards fiscal outcomes reported. The Fiscal Strategy includes macroeconomic and fiscal forecasts, which lack some key elements, such as interest rate projections, and explanations of differences from the previous forecasts.

➢ Management of fiscal risks, public investments, and assets. These three areas are either not regulated or provide only simple management mechanisms since they are at an early stage of development. These weaknesses contribute to potential for sub-optimal use and management of funds and their related impact. The institutional set-up for monitoring fiscal risks is dispersed and includes only basic tasks and analysis, particularly for public corporations and local self-government related risk. There is no dedicated regulations, guidelines or standard criteria for identification, appraisal, prioritization and selection of capital investments, except for externally financed projects where procedures are driven by the financier. While records of major categories of financial and non-financial assets exist, they are too decentralized and fragmented to allow meaningful dialogue on performance of both portfolios. Data, in particular, is fragmented for non-financial assets, with concerns about accuracy.

➢ Performance information and management. Program budgeting practices are underdeveloped. While information on programs and expected performance is included in the budget, program budgeting has not yet been formally adopted, and remains at an immature level of development. Strategic and annual plans include information on program objectives, costs, expected results and performance indicators. Budget users prepare semiannual and annual reports on the implementation of programs and progress towards achieving objectives. However, there is no established mechanism for comparing the results with targets, and reliability of available data is uncertain. Nonetheless, the SAO is reviewing government performance with increasing institutional and financial coverage.

➢ Accounting and Reporting. Published in-year budget execution reports are comparable to the approved budget only at the administrative and highly aggregated levels of economic classification. While in-year reports are timely and there are no material concerns about their accuracy, they capture the expenditures only at the payments stage with no information on commitments or liabilities. The Open Finance Portal is an improvement in terms of transparency of treasury operations. Annual government financial statements (the final account) include only revenue and expenditures while only individual budget users prepare Balance Sheets and present assets and liabilities, but these are not consolidated. Annual government financial statements are submitted timely for external audit, however the accounting standards used in their preparation are not disclosed.

➢ Revenue Administration. Comprehensive and up-to-date information on revenue rights and obligations is available but revenue risk management, audits and investigations and level of tax arrears lag behind and register weak performance. With regard to accounting for revenue, timeliness of information and funds transfer related to revenue collections is adequate, while frequency of reconciling revenue accounts could be improved.

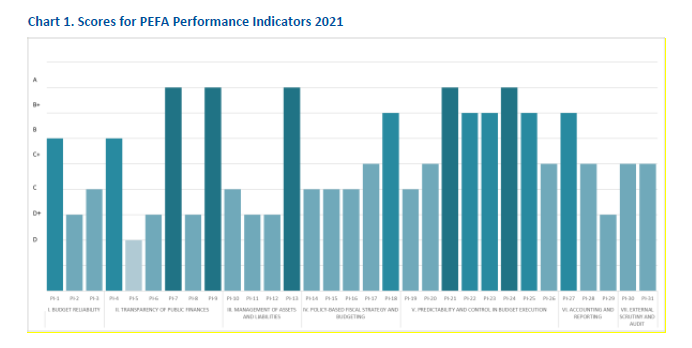

Chart 1. Scores for PEFA Performance Indicators 2021

Impact of PFM performance on budgetary and fiscal outcomes

Aggregate fiscal discipline. Aggregate fiscal discipline aims to align the levels of revenue and expenditures without creating significant fiscal deficits which could jeopardize fiscal sustainability and manage spending within the available fiscal space. Regarding expenditure management, budget execution is performing well which contributes to the overall fiscal discipline. Deviations between the budget execution and the approved budget on the expenditure side are low to moderate. While there are hard controls embedded in the budget execution system at the payments stage, which allows spending by budget users only within approved budget allocations, there is no established mechanism which prevents the budget users from entering into contractual commitments which exceed annual and medium-term allocations and estimates. Fiscal information is transparent and publicly accessible and all relevant budget classifications are in place. As discussed above, the Budget documentation does not comprehensively include all the needed elements.

On the revenue side, revenue administration faces challenges with risk management, tax audit and tax arrears. Deviation of executed versus budgeted revenue registered a moderate seven percent in 2018 and 2019, with a more significant deviation of 16 percent in 2020 as a consequence of the pandemic.

Medium-term perspectives in planning and budgeting and program budget are rather formalistic and provisional and could be detrimental to fiscal discipline and present challenges if a fiscal rule is introduced as envisaged in the draft Organic Budget Law. This also applies to the quite basic fiscal risk monitoring.

Strategic allocation of resources. Allocating resources in line with strategic priorities contributes to maximizing the impact of public spending for an efficient public sector and economic growth.

Ministries adopt costed medium term plans and a link between those documents and the budget can be established. However, medium-term targets are not binding and deviations from previous estimates and targets are not properly analyzed. Performance management and measurement of results are basic, which hinders budgeting based on performance and maximizing its positive long-term impact. This is largely because program budgeting has not been formally introduced, although some elements of program budgeting are applied in practice. Budget users provide information on programs and expected performance, however there is no established system for measuring results achieved against plans, and the quality of performance information provided is uncertain.

A fairly credible budget and sound budget execution favorably influence the strategic use of funds. Procurement management is scored at the higher end, which supports the execution of strategic allocations.

The weak public investment management system negatively influences the strategic allocation of resources, given that selecting capital projects with strategic significance is crucial. Lack of an effective system for management of fiscal risks can result in unplanned demands on the budget if fiscal risks materialize, which shrinks the fiscal space for strategic allocations.

Efficient service delivery. The reasonably credible budget enables implementation of service delivery expenditures, although a high variance in the composition of expenditures can pose risk of reallocation of service delivery funds to other expenditure categories, in particular from capital investment to less growth-enhancing recurrent spending. While information on revenue collections is timely and accurate, the accumulation of tax arrears can carry a risk of insufficient revenue levels to execute service delivery programs. Transparent fiscal information and reliable budget execution reports facilitate appropriate monitoring of service delivery programs. The sound budget execution system and controls provide a good foundation for executing budget allocations intended for service delivery in an orderly manner. MoF’s information system that supports arrears registration provides some assurance that allocated funds for service delivery will not be subject to reallocations on an ad-hoc basis to settle overdue payments from previous periods.

Weak program budgeting and performance management prevent meaningful analysis of the efficiency of service delivery. Appropriate measurement of achieved results, key performance indicators, outputs and outcomes for each budget program would be highly beneficial for informing funds allocation and more efficient service delivery in the medium to long term. The current lack of effective systems of managing public investments and public assets can also be detrimental to ensuring adequate infrastructure for various service delivery sectors, such as health, education, transport, electricity, and water supply.

The well performing external audit by the SAO and parliamentary oversight provide additional scrutiny over expenditures related to service delivery. Further developing the internal audit function would contribute to improving the systems and governance in service delivery units.

Performance changes from previous assessment PFM performance registered an overall improvement compared to 2015.

Out of 28 performance indicators, 11 indicators maintained equal rating, 11 indicators registered improved scores (most due to improved performance), and only six indicators showed deteriorated scores (two on account of reinterpretation of the evidence against the scoring criteria). Reforms in the period between the two assessments have resulted in a mix of improved upstream and downstream PFM practices, without losing ground on earlier improvements documented in 2015. Major reforms are pending parliamentary approval of the authorizing legislation.

The improvements in scores relate primarily to the areas of budget formulation, budget execution and reporting, and external oversight. The improved performance and scores between the successive PEFA assessments more specifically relate to: monitoring of arrears; assessed aspects of tax administration; public procurement; internal controls; in-year budget reporting; external audit; and legislative scrutiny of the budget proposal and the final account. Scores on indicators on payroll control have improved nominally only, as the underlying practices remained largely unchanged compared to 2015. Of the 11 indicators that retained the same rating as in 2015, three scored A, two scored B/B+, four scored C/C+ and two indicators scored D/D+.

Performance and scores deterioration have been limited and some relate to consequences of the pandemic and reassessment of performance against the PEFA criteria. Score has deteriorated in terms of performance on the extent of the variance in expenditure composition during the last three years as well as on the comprehensiveness of information included in budget documentation (on account of higher portion of directly managed EU funds). Scores have nominally deteriorated on budget classifications and guidance for preparing budget submissions. Scores have also nominally deteriorated on debt management indicator as a result of reassessment of evidence available against PEFA criteria, while the underlying performance has remained stable and even improved in some aspects. On the annual financial statements, the change on timeliness dimension was caused by COVID-related disruptions while the dimension on accounting standards was scored lower due to reinterpretation of available evidence while performance has not changed.