Bangladesh 2023

EXECUTIVE SUMMARY

Rationale and Purpose

1. The objective of the Public Expenditure and Financial Accountability (PEFA) Assessment for 2022 is to provide an assessment of public financial management (PFM) performance based on indicator analysis and other key information. This is to be done in a concise and standardized manner, following the 2016 methodology. This new framework assesses the impact of PFM weaknesses at the three levels of budget outcomes, namely overall fiscal discipline, strategic resource allocation, and efficient service delivery. The framework consists of seven pillars and 31 performance indicators that measure the operational performance of key elements of PFM systems, processes, and institutions.

2. The 2022 PEFA assessment is the fourth assessment to be conducted in Bangladesh. Previous PEFA Assessments were conducted in 2006, 2010, and 2015. The 2016 PEFA assessment showed some improvements compared to the previous 2010 PEFA. However, Bangladesh’s overall PFM performance remained below the average score of ‘C/C+’ for six of the seven PEFA pillars.

3. This assessment was government-led and included consultations with non-state actors, the private sector, and development partners. The World Bank and the Asian Development Bank (ADB) jointly provided technical quality assurance for the assessment through the Management and Oversight Structure. All 31 indicators of the PEFA 2016 methodology were used. Three dimensions of Performance Indicator (PI) 26 were not applicable. As there is not yet a formal internal audit function in the central administration, dimension 26.1 is rated D and dimensions 26.2, 26.3, and 26.4 are rated NA.

4. The peer reviewers included representatives from the World Bank as lead agency, the Asian Development Bank (ADB), the International Monetary Fund (IMF), The Global Affairs Canada, the European Union, Government of Bangladesh (GoB) officials, and the PEFA Secretariat. Issues raised during the peer review of the draft report were addressed through a matrix of the assessment team’s responses. The updated/final report was submitted to the PEFA Secretariat for the PEFA Check. The overall assessment will benefit from lessons learned from the World Bank’s and other development partners’ ongoing PFM reform engagements.

5. The GoB assessment team counterparts provided access to all necessary administrative data. The nature and extent of data collection, the meetings required, and the coordination with government officials were clearly communicated as part of the initial data request. They were reiterated during the PEFA methodology workshop. Given the ongoing COVID-19 pandemic situation, most of the activities were conducted virtually. However, the national consultants held face-to-face meetings with GoB officials whenever possible.

6. The main recipient and owner of the final report is the Finance Division of the Ministry of Finance. As in the past, this report will be published on the official government website and permission will be sought for publication on the PEFA website. A dissemination will be held for stakeholders, including line departments, academia, the Chamber of Commerce, relevant non-state actors and development partners.

7. The results of the diagnostics will be used as part of the dialogue and resource mobilization for the implementation and achievement of the overall PFM reform objectives in order for Bangladesh to achieve and sustain its upper middle income status aspirations. Hence, the theme of the four mutually reinforcing diagnostics is “Towards a resilient PFM system for sustainable socio-economic development as an upper middle-income country”.

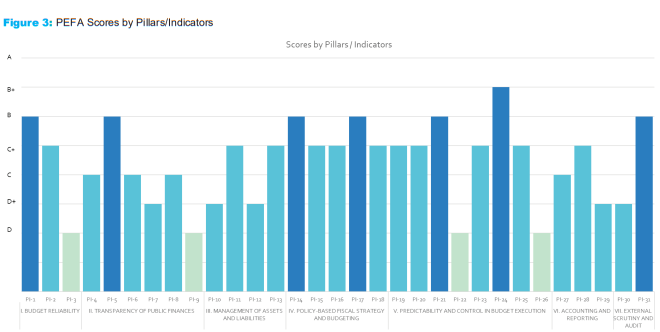

Main Assessment Results

8. An analysis of PFM performance by pillars shows that the pillar “IV. Policy-based fiscal strategy and budgeting” has a good performance. The pillars “V - Predictability and control in budget execution, “VI. Accounting and reporting” and “VII. External scrutiny and audit” have a performance above average. The pillars “I. Budget reliability”, “II. Transparency of public finances” and “III. Management of assets and liabilities” show a basic performance.

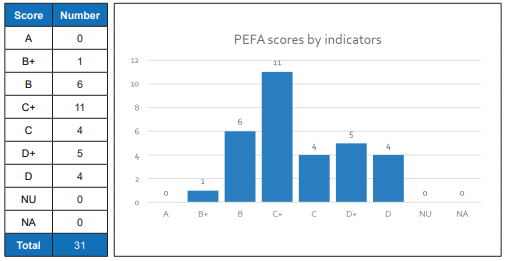

9. The analysis of the PEFA scores shows that 9 indicators have a score equal to D or D+, 15 indicators have a score equal to C or C+. Another 7 indicators have a score equal to B or B+ (Figure 1).

Figure 1: PEFA Scores by Indicators

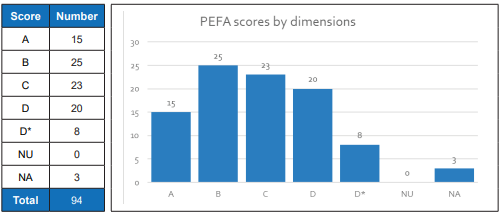

10. Analysis by dimension shows a more favorable picture. In this regard, 40 dimensions have a score equal to A or B, and 51 dimensions have a score equal to or lower than a C. Three dimensions are not applicable (Figure 2).

Figure 2: PEFA Scores by Dimensions

Main Strengths and Weaknesses of the PFM Systems

Strengths

Key strengths are the completeness of budget documentation presented to Parliament, annual performance plans and reports prepared to monitor service delivery, e-procurement which now covers 70% of procurement. In addition, independent review boards have been established for complaint management and financial reporting is comparable to IPSAS cash. The independence of Comptroller and Auditor General is constitutionally guaranteed, and the legislature makes recommendations after reviewing external audit reports on budget execution.

11. In terms of transparency, the budget documentation presented to Parliament is complete (PI-5). Most transfers are formula-driven (PI-7). Annual performance plans and reports are prepared to monitor service delivery (PI-8). With respect to asset and liability management, tracking is done properly, although there are weaknesses in physical tracking (PI-11). Financial assets are reported annually in the financial accounts prepared by the Controller General of Accounts (CGA).

12. With regard to budget preparation, projects are selected according to criteria and most of them are subject to economic analysis. A budget strategy is developed and forwarded to the legislature (PI-15). The budget schedule has clear ceilings, which are then approved by the cabinet. It allows sufficient time for ministries, divisions and agencies to prepare budgets (PI-17).

13. For monitoring budget execution, cash flows are prepared annually and updated monthly. Ministries, divisions and agencies can plan their expenditures at least one quarter in advance. Budget adjustments are made in a clear and transparent manner (PI-21). In addition, E-procurement now covers 70% of purchases, allowing for accurate tracking. This ensures that over 70% of contracts are awarded using competitive methods. The public has good access to statistics, although there is no annual statistical report. Independent review panels have been established for complaint management (PI-24). At the accounting and reporting level, bank reconciliation of all active headquarters bank accounts is performed within three days. The integrity of financial data is monitored by a team from the Ministry of Finance (PI-27). The financial reports contain information on cash balances, revenues, expenditures, financial assets and liabilities, and debts. However, they do not provide information on guarantees (PI-29). The financial reports are comparable to the International Public Sector Accounting Standards (IPSAS) cash (PI-29).

14. With respect to external oversight, the independence of the Office of the Controller and Auditor General (OCAG) is constitutionally guaranteed (PI-30). The legislature issues recommendations after reviewing external audit reports on budget execution. These recommendations are generally followed, although not systematically (PI-31).

Weaknesses

15. The main weaknesses relate to the lack of credibility, transparency and preparation of the budget, as well as some shortcomings in the monitoring of budget execution and in external control.

16. At the level of budget credibility, budget execution deviated significantly from the initial budget. During the evaluation period, both revenues and expenditures deviated from the initial budget, particularly due to the setting of targets rather than estimates at the revenue level (PI-3), as well as because of difficulties related to land acquisition and contracting at the expenditure level (PI-1 & PI-2).

17. In terms of transparency, no extra-budgetary operations were reported in the fiscal reports (PI-6). Information concerning financial transfers to decentralized local governments is provided only at the time of the transfer (PI-7). The government has made little budget information available to the public (PI-9). The monitoring of the sub-national governments (SNGs) is lacking. State-owned enterprises (SOEs) are monitored, albeit with a time lag. Contingent liabilities and fiscal risk monitoring are no longer reported (PI-10). Non-financial assets are not fully tracked, and the disposal of assets is reported for only for a few assets (PI-12).

18. In terms of budget preparation, the legislature has less than a month to review the budget (PI-17). At the budget execution monitoring level, only a few entities use a structured and systematic approach for assessing and prioritizing compliance risks for revenue streams. The majority of entities collecting government revenues undertake audits and fraud investigations. However, they do not use a compliance improvement plan, nor do they complete the majority of planned audits and investigations. The selection of audit cases is not sufficiently based on risk analysis. The limited sharing of information between the three income tax branches hampers effective risk management. In addition, there is no medium-term strategy for improving revenue collection. Finally, there is no accurate record of revenue arrears (PI-19).

19. While there are no official records of arrears, it is a common occurrence in practice on the expenditure side. (PI-22). There is no formal internal audit at the budget execution level. Only ex-post reviews of financial compliance have been conducted by the MDAs (PI-26). At the accounting and reporting level, advance accounts are never cleared, except for those related to salaries (PI-27). Financial reports are certified by the OCAG more than 9 months after the end of the fiscal year (PI-29).

20. External auditing covers all GoB entities and primarily focuses on ensuring compliance. However, reports on the central government’s budgetary financial statements are submitted more than 9 months after the end of the period, and there is a significant backlog of audit reports. Although there is a follow-up system in line with one of the external audit’s recommendations, it is not always enforced (PI-30). Unfortunately, parliamentary committee reports are not available to the public (PI-31).

Impact of PFM Performance on Budgetary and Fiscal Outcomes

Aggregate Fiscal Discipline

22. The credibility of the budget is weak due to a combination of factors, including unrealistic revenue forecasts, challenges in land acquisition and contracting, and the regular practice of passing a supplementary budget law each year. In addition, some extrabudgetary transactions go unreported, and some public enterprises fail to submit their annual financial statements on time. There is inadequate reporting on asset disposals and debt reporting lacks sufficient detail, although the government has plans to implement a medium-term debt management strategy. While the medium-term budgeting framework includes threeyear spending estimates, it is not aligned with strategic plans and lacks strong comparisons to previous frameworks. Nevertheless, budget reports cover all items and are generally timely and accurate, though some revenue data is not highlighted

Strategic Allocation of Resources

23. The budget’s lack of credibility affects its performance and there is an inconsistency in the use of the budget classification system for formulation, execution, and reporting. Budget reports do not include information on extra-budgetary operations, and details on transfers to SNGs are limited. Physical monitoring of projects included in the budget is sometimes inadequate. While the budget strategy is reported to the legislature, planned actions to address variances are not reported, and the Medium Term Budget Framework (MTBF) lacks alignment with strategic plans and comparisons with previous MTBFs. Although reporting coverage and comparability are for all budget items, some revenue data is not highlighted.

Efficient Use of Resources for Service Delivery

24. The lack of budget credibility affects the Efficient Use of Resources for Service Delivery. Information about financial transfers to local governments is limited and weakly linked to expenditures. Little budget information is available to the public. The MTBF is not aligned with strategic plans and comparisons with previous MTBFs are weak. There is no reconciliation of estimates and arrears. Payroll control is robust, and e-procurement covers 70% of purchases. There is no formal internal audit, and external audit coverage is less than 50%. The SAI’s independence from the executive branch is compromised, and the PAC reports are not disclosed to the public

Performance Changes since the Previous PEFA Assessment

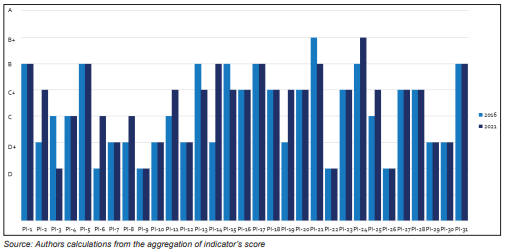

25. The PFM performance has slightly improved from the previous evaluation, as per Figure 7. Notably, there are improvements in Pillar II, which pertains to the transparency of public finances, and in Pillar V, which deals with predictability and control in budget execution.

26. The 2021 PEFA Assessment for Bangladesh has been conducted using the 2016 methodology. As such, it was possible to compare scores against the previous assessment, which also used the same methodology.

Evolution of Scores by Indicators between the 2016 and the 2021 PEFA Assessments

27. The previous PEFA assessment found that much of the legal and regulatory framework for effective PFM was already in place. Since then, despite the modernization of information technology (IT) through iBAS++ and the payroll management system, progress in PFM performance has been uneven. It has shown insufficient results in budget credibility, transparency, accounting and reporting, and internal/ external audit and oversight. The main problem is that there are still significant delays in the preparation of financial statements, which hampers transparency. The same is true for external audit and oversight. The scores improved for 6 indicators, decreased for 1 indicator and remained unchanged for 15 indicators. Nine indicators could not be compared.