Rwanda 2022

Executive Summary

Purpose and management

The objective of the PEFA assessment is to draft a comprehensive “PFM – Performance Report” (PFMPR) prepared according to the 2016 PEFA Performance Measurement Framework so as to provide an analysis of the overall performance of the PFM systems of the country as well as to follow-up on progress against the PEFA indicators from the 2016 assessment for purposes of measuring over time, changes in performance. In addition to the main PEFA assessment, a gender responsive PFM (GRPFM) and climate responsive PFM (CRPFM) assessments were conducted to provide a baseline for monitoring and evaluating the extent to which gender and climate change are mainstreamed into the central government PFM systems, the result of which will lead to the development of PFM reform strategy with gender and climate change perspective. Box 1.1 below outlines the assessment management framework, oversight, and quality assurance. The assessment was funded by a multi-donor basket fund with contribution from Belgium and Germany.

Mr. Vincent Nkuranga (Coordinator of Single Project Implementation Unit - SPIU, MINECOFIN) was the assessment manager and a member of the oversight team. Mr. Richard Tusabe (Minister of State in charge of National Treasury, MINECOFIN), was the chair of the oversight team. He provided general leadership and guidance. Mr. Vincent Nkuranga organised and secured all meetings as well as ensured the timely provision of all relevant documentation. He was responsible for the organisation of the PEFA training workshop held in Kigali. Other members of the oversight team include the Accountant General, the Auditor General, and the Deputy Commissioner General of RRA, representatives of development partners from ENABEL/Belgium, Germany/KfW, and UK-FCDO.

Scope, coverage, and timing

The assessment covered central government ministries and departments (specifically Ministry of Finance and Economic Planning: National Budget Directorate, Macroeconomic Policy Directorate, National Development Planning and Research Directorate, Public Debt Unit, Office of Government Chief Internal Auditor, Fiscal Decentralisation Unit, Public Financial Management Reform Unit, Tax Policy Division); Rwanda Environment Management Authority; Ministry of Education; Ministry of Health; Ministry of Infrastructure; Gender Monitoring Office; Accountant General’s Department; Rwanda Public Procurement Authority; Rwanda Revenue Authority; Office of the Auditor General; subnational governments for purposes of assessing PI-7 and PI-10.2; Rwanda Social Security Board (RSSB) and other extra budgetary units1, public enterprises (in so far as they affect central government fiscal risk; and Parliament).

The fiscal years for this assessment are FYs 2018/2019, 2019/2020, and 2020/2021. The last budget submitted to Parliament for purposes of this assessment was FY2021/2022 budget submitted in FY2020/2021. The cut-off date was June 2021, as per the ToR.

The field mission began on Monday 11th April 2022 with a kick-off meeting with MINECOFIN and ended on 4th May 2022 with a debriefing meeting also with MINECOFIN. A day’s standard PEFA, PEFA Climate and GRPFM training workshop was organised on 25th April 2022 with participants from key GoR officials, development partners. The assessment was jointly conducted by international and local PEFA experts.

Annexes 3A and 3B provide detailed lists of information used and people interviewed, respectively. Other official material used for this assessment include IMF Article IV Staff Report dated December 2021 and Transparency International Report 2020 and 2021. For the standard PEFA, all 31 performance indicators and 94 dimensions were used, but one dimension (PI-27.2) was not applicable because there are no suspense accounts. All 9 performance indicators related to gender responsive PFM (GRPFM) assessment were assessed and applicable. There are 14 PEFA climate indicators; all but one (CRPFM-9) were assessed and applicable. CRPFM-9 was not applicable because there were no climate-change related taxes.

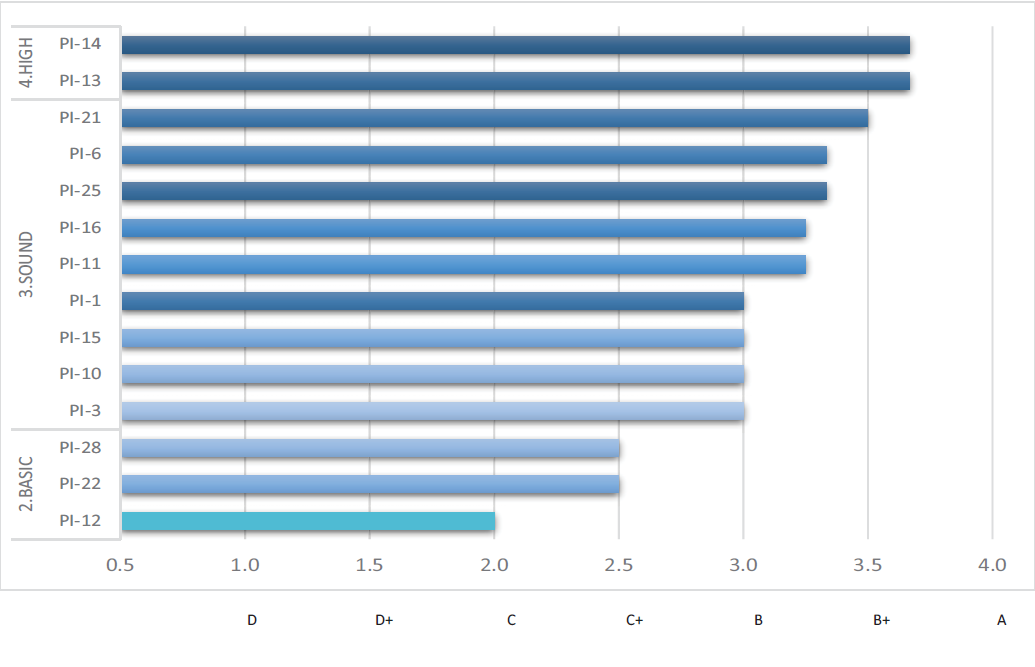

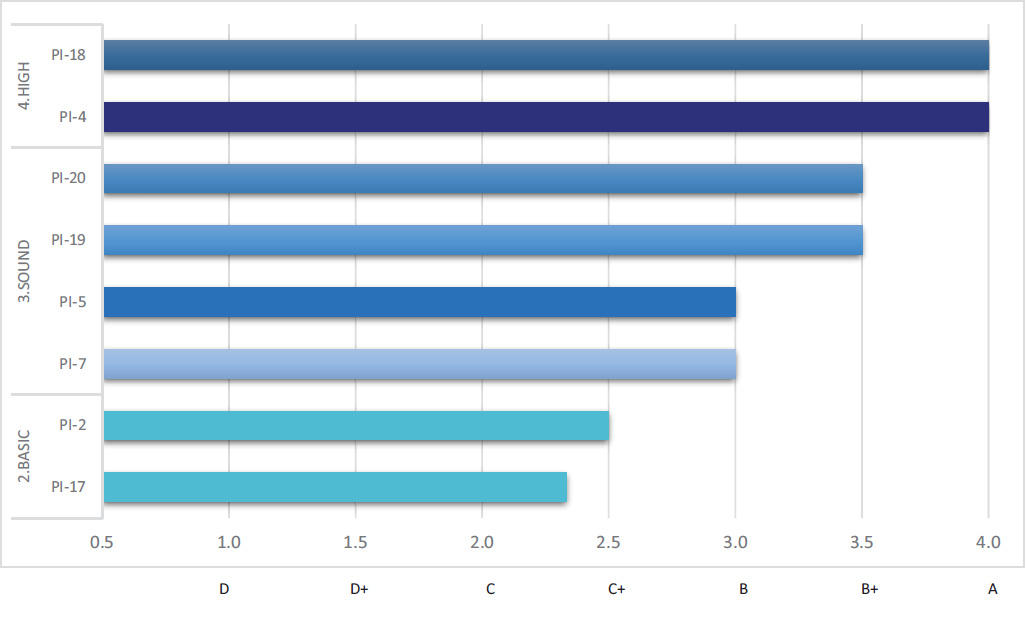

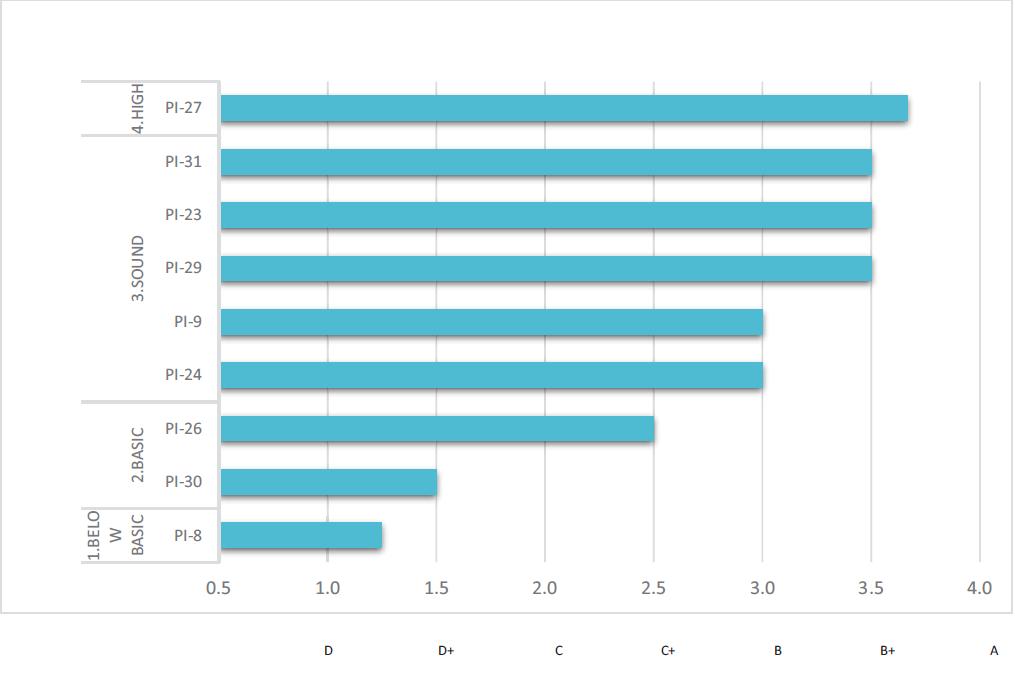

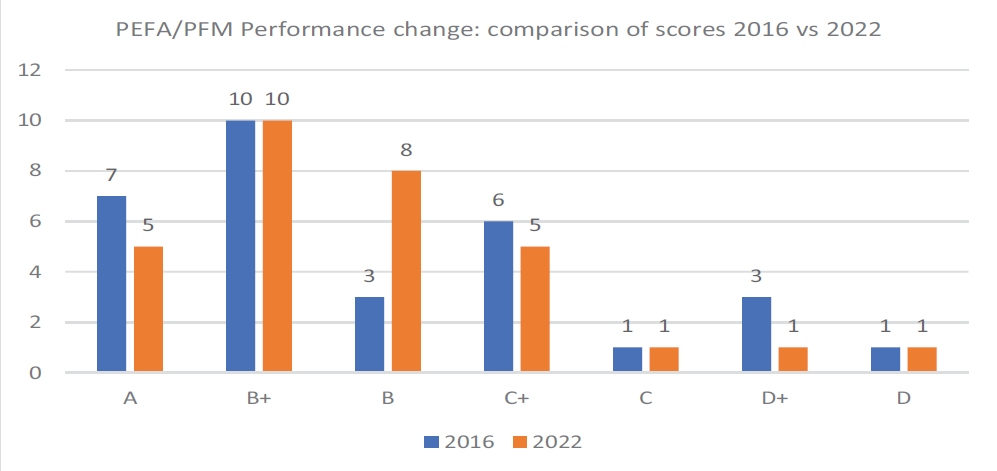

Table 1.0 below outlines summary of overall PEFA/PFM performance scores in 2022. Chart 4 provides a graphical representation of PFM performance change since 2016, chart 5 overall PFM performance in 2022 by indicator, and chart 6 overall ranking by indicator.

Impact of PFM systems on the three main budgetary and fiscal outcomes

Aggregate fiscal discipline

Aggregate fiscal discipline is sound, as shown in chart 1 below. Fiscal discipline is strengthened by the reliability of aggregate revenue and expenditure outturns, as well as the reasonable level of composition variances on both revenues and expenditures. Fiscal discipline is also strengthened by the low levels of in-year budget reallocations, done within clear guidelines and strict limits, as well as a robust and verifiable macroeconomic framework which support revenue projections. The general internal control framework shows reasonable performance, with the existence of strong PFM laws and regulations that provide clear guidance on the segregation of duties, supported by political will to enforce PFM laws – these contribute to strengthening fiscal discipline. Fiscal discipline is strengthened further by the inclusion of all expenditure in financial reports and the timely submission of financial reports by extrabudgetary units to the government, though this is undermined by the high level of revenue outside of financial reports. There is also a sound cash management framework, together with sound public investment and payroll management systems, all strengthening fiscal discipline.

Another strength to fiscal discipline is the effectiveness of expenditure commitment control framework, but now undermined by low levels of compliance with payment rules and regulations. Strong debt management system, in addition to the comprehensiveness of recording and reporting on central government fiscal risks, have contributed positively to fiscal discipline. Fiscal discipline is however weakened by the accumulation of both revenue and expenditure arrears.

Chart 1

Aggregate fiscal discipline

Strategic allocation of resources

As shown in chart 2, strategic allocation of resources is sound. Good budget classification system coupled with comprehensiveness and transparency of the budget have contributed positively to strengthen strategic allocation of resources. This means that resources can be tracked throughout the budget’s formulation, execution, and reporting cycle. The legislative scrutiny of the budget, which shows sound performance, has also ensured that public resources are allocated to government priority areas according to plan. The mechanism for allocating resources to sub-national governments is sound, as it is rule-based

and transparent, allowing SNGs to effectively plan for the delivery of primary services. The performance of revenue administration and accounting framework is sound to support strategic resource allocation and ensure a timely flow of resources to service delivery units.

Strong macroeconomic and fiscal forecasts, a fiscal strategy that sets clear fiscal policy objectives and a medium-term perspective in budgeting enable government to more effectively plan budget allocations in accordance with priorities, contributing to strengthening strategic resource allocation, except for the fact that the BCC does not provide cabinet approved ceilings and the budget is not submitted to the legislature early enough to ensure effective scrutiny. The relatively minimal in-year budget adjustments help to ensure resources are allocated according to plan. The coverage and classification of data in the in-year reports allows for a direct comparison of actual expenditure to the original budget for all items of expenditure, key to ensuring that resources are allocated to originally intended government priority areas. Nevertheless, the issuance of in-year budget execution reports which experiences some delays, limits the ability of citizens to effectively track resources transparently.

Chart 2

Strategic allocation of resources

Efficient service delivery

Chart 3 below presents a graphical view of the performance of efficient service delivery, indicating sound performance at aggregate level. Sound legislative oversight through the review of OAG audit reports has contributed to strengthening efficiency in service delivery, in addition to sound financial data integrity systems which ensures that accounts are reconciled timely. The efficiency of the service delivery is positively impacted by good budget classification system in place as well as the transparency of budget documentation. The reliability of both the revenue and expenditure budgets at aggregate and composition level, coupled with the minimal in-year budget adjustments, helps the achievement of efficient service delivery. Efficient service delivery is also supported by transparent fiscal information regime that allows publication of most government fiscal data on time. Sound public investment management framework, as reflected under fiscal discipline, ensures that public funds are invested judiciously to promote efficiency in service delivery.

Efficiency in service delivery is strengthened by the good system in place for medium term expenditure estimates, providing greater predictability for budget allocations in the medium-term. This is however undermined by the fact that the ceilings are not approved by Cabinet before the issuance of the budget circulars. Performance information of primary service delivery performs poorly, particularly for resources received in kind, thereby limiting citizens’ ability to demand accountability. The strong procurement management framework, coupled with a relatively strong internal audit, have contributed to strengthening the efficiency of service delivery.

Chart 3

Efficient service delivery

Performance changes since last assessment in 2016

The chart below (chart 1) summarizes PEFA/PFM performance change since the last assessment in 2016. “A” scores have dropped from 7 in 2016 to 5 in 2022. There is no change in “B+” between 2016 and 2022, both assessments having 10. There is improvement in “B” scores from 3 in 2016 to 8 in 2022, with a decline in “C+” scores at 6 in 2016 to 5 in 2022. “C” scores, on the other hand, have remained unchanged, at 1 in 2016 and 2022. Whilst “D+” scores have dropped from 3 in 2016 to 1 in 2022, “D” scores have remained unchanged at 1 in 2016 and 2022. Overall, PFM performance has declined since 2016. The decline is partly due to the negative effect of COVID-19.

Chart 4

PFM performance change

Fiscal discipline

Not much has changed between 2016 and 2020 as far as fiscal discipline is concerned, as it continues to be reasonably strong in relation to PFM rules and regulations. The OBL 2013 remains the main PFM legal framework, and has been strengthened by the financial regulations of 2016 and the procurement regulations of 2020. Both aggregate and composition outturn of revenues and expenditures continue to be reliable, a positive impact on fiscal discipline. In both assessments, in-year budget reallocations are kept to a minimum and effected according to clearly spelt-out guidelines, which contribute to strengthening fiscal discipline. There is a reasonably strong macroeconomic and fiscal projection environment that supports revenue forecasts, a prerequisite to fiscal discipline. In the current assessment, fiscal discipline has been strengthened by the comprehensiveness of fiscal risk reporting which includes SoEs, SNGs, and PPPs – this was not the case in 2016. In both assessments, there is reasonably strong external audit (except for financial independence of OAG) and legislative oversight functions, ensuring that the executive is held accountable for the use of public funds. Payroll controls have remained strong in both assessments, contributing to strengthening fiscal discipline.

Another strength to fiscal discipline is the low level of revenue and expenditure of extra-budgetary units outside central government operations – this appears to be deteriorating in the current assessment compared to 2016; this is a weakness to fiscal discipline. There is also a concern regarding the level of revenues and expenditures arrears in the current assessment. The previous assessment recorded around 2% of both revenue and expenditures as outstanding, compared to 29% for revenue arrears, and between 7% and 11% for expenditure arrears – this is a weakness to fiscal discipline. Although expenditure commitment controls function effectively in both assessments, the level of compliance to financial management rules and procedures in 2022 is also deteriorating compared to 2016, based on evidence adduced by OAG.

Strategic allocation of resources

The good budget classification system, as well as budget comprehensiveness and transparency, which has been the case since the previous assessment in 2016, strengthen strategic resource allocation. This means that resource allocation can easily be tracked, accounted and reported. In both assessments (2016 and 2022), the existence of strong macroeconomic and fiscal forecasts, a fiscal strategy that sets clear fiscal policy objectives and a medium-term perspective in budgeting enable government to more effectively plan resource allocations in accordance with priorities, thereby contributing to strengthening strategic allocation of resources. Additionally, the timely approval of the annual budget estimates by the legislature ensures that allocated resources are utilized for planned service delivery programs. A sound public investment management framework, which has been the case since 2016 and also in the current assessment, provide reasonable assurance that scarce public resources are put to good use, thereby strengthening resource allocation. In both 2016 and 2022 assessments, the performances of revenue administration and accounting framework are good to sustain strategic resource allocation and ensure a timely flow of resources to priority areas. Again, the minimal in-year budget adjustments ensure resources are allocated to originally planned government priorities.

Major weaknesses identified in 2016 that continue to exist in 2022 with negative impact on strategic allocation of resources include some delay in the issuance and publication of in-year budget execution reports (effectively limiting public accountability and the tracking of resource allocation on time), and the issuance of unapproved medium-term and annual budget ceilings prior to budget formulation and preparation (negatively impacting on the budgeting process). Further, GoR is unable to quantify the fiscal impact of all changes to policy proposals – this is a weakness to strategic resource allocation.

Efficient service delivery

Efficient service delivery is strengthened by the existence of good budget classification, coupled with comprehensiveness and transparency of budget documentation during 2016 and 2022 assessments.

Likewise, the minimal levels of budget virements done within strict legal limits have contributed to strengthening efficiency in service delivery – this has been the case for both assessments. Both 2016 and 2022 assessments recorded satisfactory performances with regards to publication of most government fiscal data in a timely manner, allowing citizens to track the use of public funds. In 2016 and 2022, efficient service delivery has been strengthened by the fact that public investment management systems perform well in terms of conducting economic analysis and standardised project selection framework. Again, as noted in 2016 and in the current assessment, the good system in place for medium-term expenditure estimates provides greater predictability for budget allocations in the medium-term; this is however affected by the fact that the ceilings are not approved by Cabinet before the issuance of the budget circulars. Reasonably strong external and legislative oversight functions (except for the financial independence of OAG), both in 2016 and 2022, have had a positive impact on service delivery efficiency.

In spite of the above strengths, efficient service delivery is weakened by the fact that service delivery performance information is not publicly available during the current and the previous assessments.

Furthermore, comprehensive data on resources in kind to primary service delivery units is not available, limiting the ability of government to effectively track all resources to these units, in order to ensure that there are no surpluses in certain service delivery units and shortages in others. A good public procurement system promotes service delivery efficiency – comparatively, the performance of public procurement in the current assessment has largely remained unchanged. Strong internal audits are a contributing factor to strengthening efficient service delivery; this is the case in the current assessment.

PFM reform agenda

The Government’s PFM reform agenda, implemented through the current PFM strategy PFM-SSP 2018- 2024, is linked to pillar 3 of NST-1 (“Transformational Governance” under priority number 5 – Strengthen Capacity, Service delivery and Accountability of Public Institution). The overall goal of the PFM strategy is to support Rwanda’s socio-economic transformation through effective and accountable PFM. It seeks to support the delivery of NST-1 objectives in three ways: (i) to increase compliance with PFM rules and procedures to enhance fiscal controls and improve accountability (ii) to strengthen the PFM capabilities of local governments to plan and execute local investments for improved infrastructure and enhanced delivery of essential services; and (iii) enhancing the Government’s ability to raise revenues and invest those resources in core NST-1 commitments in to foster growth without compromising fiscal discipline.

The Government is still implementing the PFM-SSP 2018-2024 which has seven thematic areas (or objectives), namely: (i) expansion of the coverage and functionality of the PFM-ICT systems; (ii) development and sustainability of critical skills and partnerships for effective PFM; (iii) Increase compliance with PFM systems and international standards; (iv) Strengthening PFM systems supporting subnational investments and services; (v) enhancement of value-for-money (VFM) practices and supporting sound investment decisions; (vi) strengthening results and governance of government business entities (GBEs); and (vii) enhance resource mobilization for NST-1 priorities.

Development partners currently supporting the PFM-SSP through a multi-donor basket fund is ENABEL/Belgium and KfW (Germany). There is also support from UK-FCDO for the 2022 SNG PEFA assessments. WB, EU, AfDB, IMF and GIZ (Germany) have all provided support in varied forms to strengthen Rwanda’s PFM.

Achievements so far include but not limited to the following:

• Expansion of the coverage and functionality of the PFM-ICT systems: The roll-out of the IFMIS and Umucyo electronic public procurement systems to Local Government/Non-Budgetary Agencies (NBAs) level including all the 416 sectors (100%), 46 district hospitals (100%), 504 health facilities (100%) and 498 schools. The digitalization of national treasury and interlinkage of IFMIS with other PFM ICT systems such as Umucyo System; e-tax system; Integrated Personnel and Payroll Information System (IPPS); Internet Banking; etc, was successfully done and supported the GoR to remain resilient and provided critical responses to its citizens during the covid-19 pandemic lock downs.

• Development and sustainability of critical skills and partnerships for effective PFM: 1,275 public finance staff with a level of intermediate professional qualification as at 31 March 2021 plus 2,500 PFM officials undergoing specific trainings on International Public Sector Accounting Standards (IPSAS) and Performance Based Budgeting (PBB training).

• Increase compliance with PFM systems and international standards: External audit coverage and issuance of unqualified audit opinions has increased. Also, the Office of Government Chief Internal Audit conducted risk-based auditing for selected activities and processes at LG level, example school construction.

• Strengthening PFM systems supporting subnational investments and services: Notable achievements include: (i) successful property registration conducted in all districts; (ii) PFM mentorship and coaching programmes conducted; (iii) assessment of PFM regulations related to local government was done.

• Enhancement of value-for-money (VFM) practices and supporting sound investment decisions: Improvements to gender policy-based budgeting done by reviewing and updating the existing modules to fit them with the current data, policies and strategic frameworks. Performance-Based Budgeting (PBB) introduced on a pilot basis in priority ministries geared at strengthening the links between budgeting and sector strategic plans, in selected ministries.

• Strengthening results and governance of government business entities (GBEs): Corporate governance of GBEs improved through (i) preparation of a comprehensive Standard Operation Procedure Framework; (ii) development of M&E guidelines as well as KPIs; (iii) development of a policy and a legal framework for GBEs.

• Enhance resource mobilization for NST-1 priorities: RRA’s strategic plan was developed. Revenue collection has steadily improved with the implementation of E-tax systems and EBM for all projects. Revenue collection as a % of GDP for the FY 2019/2020 was 15.9% surpassing the initial target of 15.6%.

The Medium-Term Review of the Public Financial Management Sector Strategic Plan (PFM SSP) 2018- 2024 dated July 2021 noted the following main challenges:

- Non-compliance to PFM rules and procedures still persist.

- Rate of follow-ups on audit recommendations by public entities is declining.

- Revenue shortfalls for timely payment of expenditure commitments, leading to accumulation of expenditure arrears.

- The full benefit of MTEF for reliable resource allocation yet to be harnessed.

- Weak governance of GBEs.