Kyrgyz Republic Jalal Abad City 2021

EXECUTIVE SUMMARY

Purpose of the Assessment

Global objective for subnational PEFA assessment

The SNG PEFA assessment aims to evaluate the PFM performance of an illustrative sample representing the city and LSGs level in Kyrgyz Republic. The main purpose of the 2019 SNG PEFA assessment is to provide the Government of Kyrgyz Republic, subnational governments, and its development partners with an objective up-to-date diagnostic of the sub-national public financial management performance based on the latest internationally recognized PEFA methodology. The SNG PEFA assessment will be conducted for the first time in the country. Therefore, the 2019 PEFA assessment is intended to establish a PEFA baseline using the 2016 PEFA methodology for SNG governments.

The national and SNG assessments process seeks to build a shared understanding of PFM performance and those dimensions that require improvement. Both PEFA assessments will aim at: (i) informing the Central and subnational Governments on areas of PFM strengths and weaknesses; (ii) facilitating and updating the dialogue on PFM between Government and donors; (iii) helping donors build budget support programmes; and iv) provide an independent information to civil society on progress in PFM reforms. The results of the assessments are expected to assist the Central and local Governments in monitoring the implementation of Public Financial Management Reform Strategy and Intergovernmental Fiscal Relations Development Concept to achieve a PFM system that meets the requirements of efficiency and effectiveness and long-term sustainability.

Specific objectives

- To conduct national PEFA assessment using the PEFA framework of 2016. The methodology to be used is the official methodology of 2016 provided by the PEFA Secretariat www.pefa.org. The PEFA assessment should be done in full and include all the performance indicators. The 2018 national PEFA assessment should also provide an update of progress in PFM since the last national PEFA in 2014. During the assessment of relevant PIs and in the report the special focus on revenue from mining should be given because of the mining is the most important economic sector contribution to the budget.

- To conduct SNG PEFA assessment for Jalal Abad LSG in Sokuluk district using the PEFA framework of 2016. The methodology to be used is the official methodology of 2016 including Supplementary Guidance for Subnational PEFA Assessments (December 2016) provided by the PEFA Secretariat www.pefa.org. The PEFA assessment should be done in full and include all the performance indicators including HLG-1, the additional indicator for transfers from CG.

Impact of PFM performance on budgetary and fiscal outcomes

Aggregate Fiscal Discipline

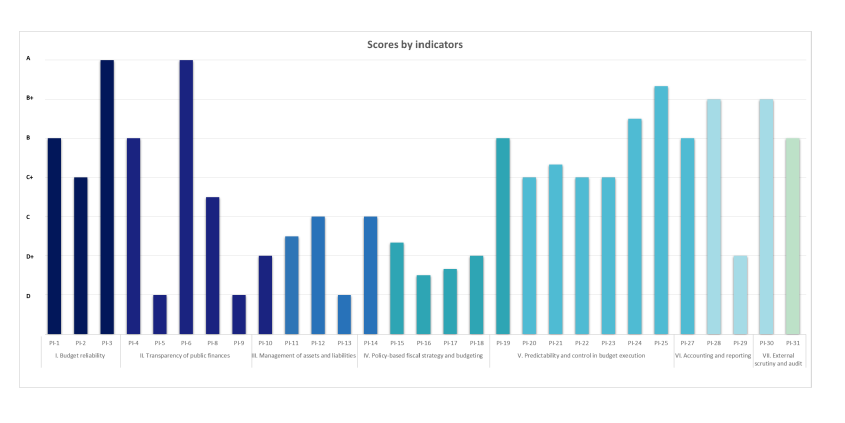

The aggregate fiscal discipline is positively impacted by the credibility revenue and expenditure budgets. Both revenue and expenditure budgets are reliable at the aggregate level (PI-1 scored B and PI-3 scored A). Earmarked transfers from central government are also received in full (HLG-1 scored A). However, this is negatively impacted by the high level of expenditure composing variance (PI-2 scored C+). Strong point to note is the low level of expenditure changed to contingency vote (PI-2.3 scored A). The classification on the budget classification is good and allows transparency; and the existence and adherence to the rules for in-year budget amendments by the executive positively contribute for fiscal discipline.

The recording and reporting of debt is complete, updated and reconciled on a monthly basis. Debt management records are complete, updated and reconciled monthly. However, debt management strategy is not prepared at the level of local governments (PI-13 scored A). Macro-economic and fiscal forecasting at LSG Jalal Abad lack basic elements.

Strategic Allocation of Resources

The significant level of budget reallocations the expenditure level negatively impacts strategic allocation of resources (PI-2). Frequent budget reallocations override government original policy intentions, leading to poor resource allocation which affects efficient service delivery, going forward. The continuous budget reallocations also raise questions about budget credibility as well as the delivery of government services based on its original policy intent.

The policy based fiscal strategy and budgeting pillar is found to be the weakest area in LSG Jalal Abad, where all indicators, PI-14 to PI-18 received the lowest scores. Most of the policy based fiscal strategy and budgeting functions are covered by the national government and hence, some dimensions are not applicable. The City of Jalal Abad prepares forecasts of the main fiscal indicators, including revenues (by type), aggregate expenditure, and the budget balance, for the budget year and two following fiscal years (PI-14.2 scored B).Expenditure budgets are not developed for the medium term within explicit medium-term expenditure ceilings (PI-16 scored D+).Budget preparation process also is weak (PI-17 scored D+). Clear budget calendar exits but data was not received regarding the date of submission of budgets by the budgetary units. Budget submission to the legislature is delayed (PI-17.3 scored D). Legislative scrutiny (PI-18) of budget also scored D+ mainly because data was not received regarding the scope and legislative procedures for budget scrutiny.

Public Investment Management (PI-11 scored D+) does not sufficiently reflect generally accepted good practice in project management. Selection of major investment projects is not based on predetermined economic selection criteria, rather made in accordance with the priorities established by the forecast of socio-economic development of the region, leading to inefficient allocation of scarce resources.

Efficient Use of Resources for Service Delivery

The rating related to the specific service delivery performance indicator (PI-8), which can demonstrate the efficiency with which services are delivered, is average (scored C+).The first and fourth dimension on performance plan for service delivery and performance evaluation of service delivery performed average while information on resources received by frontline service delivery units is collected and recorded for all budgetary institutions, disaggregated by source of funds (PI-8.3 scored A). A report compiling the information is prepared annually. Public assets management performs average, where all dimension related with financial assets monitoring, non-financial assets monitoring and transparency of asset disposals score C.

The mechanisms in place to reduce possible leakages in the system, such as payroll controls (PI-23), internal controls on non-salary expenditure (PI-25) and internal audit (PI-26) received mixed results, and rated at C+, A and NA respectively. Payroll control is strong, with the first two dimensions scoring A and the fourth dimension B. The internal audit in Jalal Abad is undertaken by the central government auditors. Financial data integrity demonstrates good accounting controls as the three dimensions performed well on bank reconciliations, suspense accounts and advance accounts.

External audit and legislative scrutiny of audit reports are found to be strong (PI-30 and PI-31) scored B+. All budget organizations of LSG Jalal Abad are covered in the external audit and the scrutiny of audit reports on annual financial reports has been completed by the legislature within three months from receipt of the reports.

Main strengths and weaknesses of the PFM systems in LSG Jalal Abad:

Strengths

- Aggregate revenue and expenditure budgets are credible at aggregate level.

- Earmarked transfers from central government are received in full.

- Expenditures from contingency are kept to the minimum.

- The budget preparation, its execution, accounting and reporting of the local budget is undertaken by classification corresponding to the GFS/COFOG standards and the existence and adherence to the rules for in-year budget amendments by the executive positively contribute for fiscal discipline.

- Debt management records are complete, updated and reconciled monthly. A strong point to note is the public access to procurement information, where all the required public procurement information is accessible to the public online through the website.

- Generally, the internal control over salary and non-salary expenditures is found to good.

- All budget organizations of LSG Jalal Abad are covered in the external audit.

Weaknesses

- Expenditure is not reliable at the composition level;

- It is not known if management and statistical reports, for internal purposes, that cover debt stock, debt servicing and debt-related operations are produced and how often; and no data was provided to assess the approval of debts and whether there is a debt management strategy.

- Aggregate fiscal risks are not well managed due to poor monitoring of the public corporation.

- Policy based fiscal strategy and budgeting is found to be one of the weakest areas in LSG Jalal Abad.

- Budget preparation process found to be weak.

- Legislative scrutiny of budgets is found to be weak.

- The key weak point of process of public investment management is that there are no approved economic selection criteria for capital investment projects and all documentation relevant to the selection and monitoring of investment projects is not published.

- Service delivery performance indicator which can demonstrate the efficiency with which services are delivered, is poor.

- Budget documentation is found to be weak where the budget submitted to the legislature met only 2 basic elements out of 4 and 1 additional element out of 8.

- Public access to fiscal information and transparency of public finances is found to be very weak.

Figure 1: Summary of PEFA scores by indicator