Kyrgyz Republic Saz SNG 2021

Purpose of the Assessment

Global objective for subnational PEFA assessment

The SNG PEFA assessment aims to evaluate the PFM performance of an illustrative sample representing the city and LSGs level in Kyrgyz Republic. The main purpose of the 2019 SNG PEFA assessment is to provide the Government of Kyrgyz Republic, subnational governments and its development partners with an objective up-to-date diagnostic of the sub-national public financial management performance based on the latest internationally recognized PEFA methodology. The SNG PEFA assessment will be conducted for the first time in the country. Therefore, the 2019 PEFA assessment is intended to establish a PEFA baseline using the 2016 PEFA methodology for SNG governments.

The national and SNG assessments process seeks to build a shared understanding of PFM performance and those dimensions that require improvement. Both PEFA assessments will aim at: (i) informing the Central and subnational Governments on areas of PFM strengths and weaknesses; (ii) facilitating and updating the dialogue on PFM between Government and donors; (iii) helping donors build budget support programmes; and iv) provide an independent information to civil society on progress in PFM reforms. The results of the assessments are expected to assist the Central and local Governments in monitoring the implementation of Public Financial Management Reform Strategy and Intergovernmental Fiscal Relations Development Concept to achieve a PFM system that meets the requirements of efficiency and effectiveness and long-term sustainability.

Specific objectives

- To conduct national PEFA assessment using the PEFA framework of 2016. The methodology to be used is the official methodology of 2016 provided by the PEFA Secretariat www.pefa.org. The PEFA assessment should be done in full and include all the performance indicators. The 2018 national PEFA assessment should also provide an update of progress in PFM since the last national PEFA in 2014. During the assessment of relevant PIs and in the report the special focus on revenue from mining should be given because of the mining is the most important economic sector contribution to the budget.

- To conduct SNG PEFA assessment for Saz LSG in Sokuluk district using the PEFA framework of 2016. The methodology to be used is the official methodology of 2016 including Supplementary Guidance for Subnational PEFA Assessments (December 2016) provided by the PEFA Secretariat www.pefa.org. The PEFA assessment should be done in full and include all the performance indicators including HLG-1, the additional indicator for transfers from CG.

Impact of PFM performance on budgetary and fiscal outcomes

Aggregate Fiscal Discipline

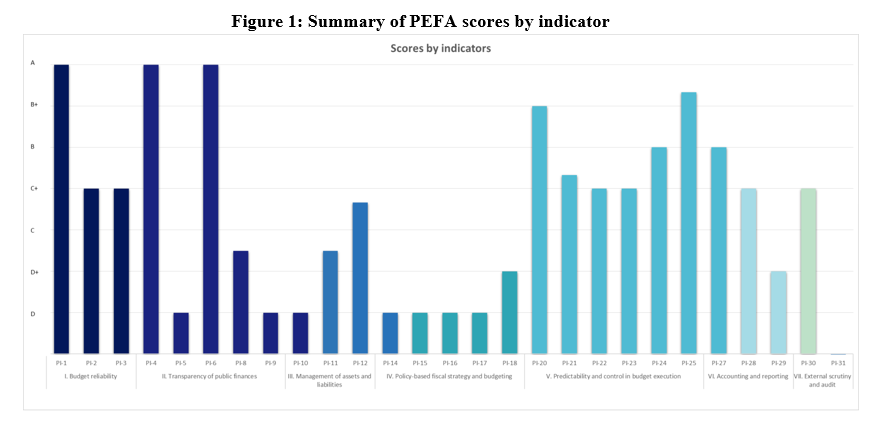

The aggregate fiscal discipline is positively impacted by the credibility of the higher-level grants, revenue and expenditure budgets. Both revenue and expenditure budgets are reliable at the aggregate level (PI-1 scored A and PI-3 scored B). The transfers from central government are also received in full (HLG-1 scored A). However, this is negatively impacted by the high level of composition variance with regard to both revenue and expenditure. The expenditure composition variance was also very high at both the functional and economic levels (PI-2 scored D+). Non-tax revenue collection was below target in all the three years, though this was compensated by over collection of tax revenue resulting in achievement of aggregate revenue targets (PI-3.2 scored C). Strong point to note is that no expenditure was charged to contingency vote (PI-2.3 scored A). The classification on the budget classification is good and allows transparency; and the existence and adherence to the rules for in-year budget amendments by the executive positively contribute for fiscal discipline.

There is no data on revenue arrears of LSG Saz since the information is collected by the regional STS in Sokuluk for the entire region and is not breakable to local governments. LSG Saz effectively lacking control over revenue arrears (PI-19 scored NA). There is also no data with respect to expenditure arrears (PI-22 scored NA). The legislature grants local governments the right to borrow by issuing municipal securities on their behalf, as well as receiving budget loans. However, The LSG Saz have not borrowed, issued debt obligations or loan guarantees in the period 2017-2019. Macro-economic and fiscal forecasting at LSG Saz lack basic elements.

Strategic Allocation of Resources

The significant level of budget reallocations at both revenue and expenditure levels negatively impacts strategic allocation of resources (PI-2 and PI-3.2). Frequent budget reallocations override government original policy intentions, leading to poor resource allocation which affects efficient service delivery, going forward. The continuous budget reallocations also raise questions about budget credibility as well as the delivery of government services based on its original policy intent.

The policy based fiscal strategy and budgeting pillar is found to be the weakest area in LSG Saz, where all indicators, PI-14 to PI-18 received the lowest scores. Most of the policy based fiscal strategy and budgeting functions are covered by the national government and hence, some dimensions are not applicable. Fiscal forecast is prepared for three years for revenue while for expenditure, for one year only (PI-14.2 scored D). The capacity of the LSG to develop and implement a clear fiscal strategy is also found to be weak (PI-15 scored D). The fiscal strategy adopted by the LSG does include quantitative fiscal objectives, but not qualitative objectives Expenditure budgets are not developed for the medium term within explicit medium-term expenditure ceilings (PI-16 scored D). Budget preparation process also is weak, PI-17 scored D. There are no budget calendars and guidance on budget preparation. Legislative scrutiny (PI-18) of budget also scored D+ mainly because the legislature’s review does not cover fiscal policies and aggregates for the coming year as well as details of expenditure.

Public Investment Management (PI-11 scored D+) does not sufficiently reflect generally accepted good practice in project management. Selection of major investment projects is not based on predetermined economic selection criteria, leading to inefficient allocation of scarce resources.

Efficient Use of Resources for Service Delivery

Low scores in PI-2 and PI-3.1 demonstrates that the PFM system with respect to efficient use of resources for service delivery does not perform well in LSG Saz. Planned service delivery activities will no longer receive the necessary funding, thereby impacting negatively on the quality of primary service delivery. Medium-term budgeting (PI-16) and public investment management (PI-11) also scored low.

The rating related to the specific service delivery performance indicator (PI-8), which can demonstrate the efficiency with which services are delivered, is poor, with all dimensions rated D, except the third dimension, on the performance plans for service delivery, which is rated A, as information on resources received by frontline service delivery units is collected and recorded for all budgetary institutions, disaggregated by source of funds. A report compiling the information is prepared annually. Public assets management performs average, where all dimension related with financial assets monitoring, non-financial assets monitoring and transparency of asset disposals score C.

The mechanisms in place to reduce possible leakages in the system, such as payroll controls (PI-23), internal controls on non-salary expenditure (PI-25) and internal audit (PI-26) received mixed results, and rated at D+, A and NA respectively. Payroll control is strong, with the first two dimensions scoring A and the fourth dimension B. There was no sufficient data to assess the third dimension, hence scored D*, affecting the aggregate score. There is no internal audit function in LSG Saz. Financial data integrity demonstrates good accounting controls as the three dimensions performed well on bank reconciliations, suspense accounts and advance accounts.

There is also no external audit function at the subnational level of the local self-government of Saz (PI-30 scored NA). The national level Account Chamber performs the external audit of the consolidated budget performance report of Sokuluk region. The external audit reports relating to the LSG Saz were not reviewed by the legislature and this has deprived the parliament from overseeing whether public resources are properly spent as planned (PI-31 scored NA).

Main strengths and weaknesses of the PFM systems in LSG Saz

Strengths

- Aggregate revenue and expenditure budgets are credible at aggregate level

- Transfers from central government are received in full.

- No expenditures were made from contingency.

- The budget preparation, its execution, accounting and reporting of the local budget is undertaken by classification corresponding to the GFS/COFOG standards; and the existence and adherence to the rules for in-year budget amendments by the executive positively contribute for fiscal discipline.

- A strong point to note is the public access to procurement information, where all the required public procurement information is accessible to the public online through the website.

- Generally, the internal control over salary and non-salary expenditures is found to good, though data was lacking to assess some of the dimension on payroll control.

Weaknesses

- Both revenue and expenditure are not reliable at the composition level.

- The legislature grants local governments the right to borrow by issuing municipal securities on their behalf, as well as receiving budget loans. However, The LSG Saz have not borrowed.

- Policy based fiscal strategy and budgeting is found to be one of the weakest areas in LSG Saz.

- Budget forecasts do not contain a mid-term forecast of socio-economic development indicators.

- Budget preparation process found to be weak.

- The legislature’s review does not cover fiscal policies and aggregates for the coming year as well as details of expenditure.

- The key weak point of process of public investment management is that there are no approved economic selection criteria for capital investment projects and all documentation relevant to the selection and monitoring of investment projects is not published.

- Service delivery performance indicator which can demonstrate the efficiency with which services are delivered, is poor.

- Public access to fiscal information and transparency of public finances is found to be very weak.

- There is also no external audit function at the subnational level of the local self-government of Saz. The national level Account Chamber performs the external audit of the consolidated budget performance report of Sokuluk region.

- The external audit reports relating to the LSG Saz were not reviewed by the legislature.