Serbia 2021

Executive Summary

Purpose and Management

This PEFA assessment provides a snapshot of the country’s PFM system performance. With the latest assessment completed in 2015, both the time period that has elapsed between the two assessments and the significant number and scope of the reforms initiated or implemented in the meantime justify the timing for the assessment. The assessment was conducted by the World Bank, with the Ministry of Finance and other relevant country institutions being the primary beneficiaries of the assessment.

The assessment informs evaluation of the implementation of the current PFM Reform Program 2016-2020, and preparation of a new program for 2021-2025. The Government of Serbia is currently implementing the Public Financial Management Reform Program (PFMRP) 2016-2020 and is in the process of preparation of the new program for the period 2021-2025. PFMRP is the key strategic document in the area of public financial management, prepared and implemented as a subset of the Public Administration Reform Strategy. During the implementation of the program covering 2016-2020, progress has been achieved in a number of areas, but further areas for improvement remain. The findings of the assessment are intended to inform the government about the changes from the previous PEFA assessment conducted in 2015, and thus support the government in assessing implementation results of the current program. At the same time, the findings are expected to inform the preparation of the new program by identifying further areas for continued reforms.

Main strengths and weaknesses of the PFM systems in the Republic of Serbia

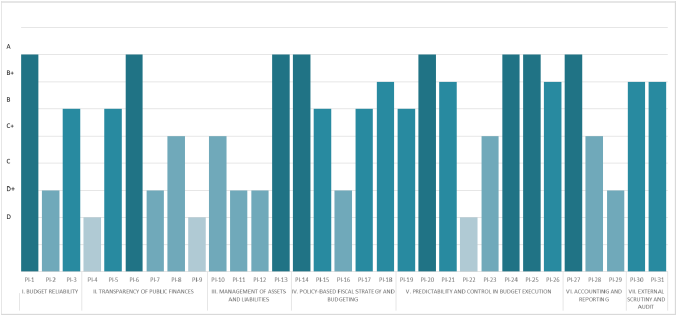

Chart 1. Scores for PEFA Performance Indicators 2020

As indicated in Chart 1 above, the assessment has identified the following main strengths of the country’s PFM system:

✓ Budget formulation. Budgets are reliable, with deviations of actual revenue and expenditure outturns compared to those budgeted remaining low to moderate, while only the deviation in the composition of expenditures by functions registered more significant margins. The Budget is presented according to all relevant budget classifications, broadly in line with GFS2014 or comparable to it, however in year budget reports are not prepared in comparable format to the annual budget and annual reports. Budget documentation is fairly comprehensive and includes most of the key elements, and most of the key fiscal documents are transparent and publicly available, despite a lower end score based on the methodology requirements. The Budget preparation calendar is embedded in legislation and complied with in general. The level of central government operations which remain unreported is low.

✓ Budget execution. Budgets are executed within approved allocations, for which hard controls are embedded in the system for all beneficiaries integrated in the budget execution system (all direct budget beneficiaries and part of indirect budget beneficiaries). The funds during the year available for budget execution are predictable and there are no delays or bottlenecks based on liquidity issues, due also to a solid revenue administration. While there is still some challenges for public internal financial control, internal audit and financial management and control within budget beneficiaries increasingly contribute to a control environment and safeguard of public funds. Revenue administration and public procurement are progressively aligning with good practices.

✓Debt management. There is a three-year debt management strategy and monitoring of its implementation. The annual budget law includes an annual borrowing plan for the year. There is a single entity in charge of government borrowing. Records and reports related to public debt are kept up to date and published monthly and quarterly.

✓External Audit and Scrutiny. The SAI is independent and conducts its audits in line with the annual audit plan and international standards, while the number of audited entities and the audit coverage beyond statutory audits is dictated by the institution’s capacity. In any case, the most material accounts, namely the consolidated BCG accounts and consolidated accounts of all SSFs are audited each year. All audit reports are duly published shortly after completion. Procedures and practices for the parliament’s review of the annual budget are appropriately established, and the review of the government’s financial statements (final account) has improved.

The following was assessed as areas for continued reforms and further improvements:

✓Strategic perspective in the use of public funds. While most public policy documents are costed and at the time of assessment there were 77 strategies (national, sectoral, and some institutional) and 26 Programs, the linkage to the central government’s budget is not always obvious. Ad-hoc annual priorities seem to be prioritized in budget allocations quite frequently, which shrinks the space for strategic activities, and thus delays or prevents implementation of strategies. Clear and consistent strategies and their implementation contribute in the medium to long term to a more efficient public sector and create the environment for economic growth. Longer time span will likely be needed for the expected benefits of improved planning coordination and budgeting of public policies under the Law on Planning System (adopted in April 2018) to materialize.

✓Medium-term budgeting. Medium-term ceilings and estimates are prepared for the budget year and two following years, and included in the Fiscal Strategy and budget documentation. However there is little evidence that those are taken as a starting point or deviations explained during the following year’s budget preparation. This hinders efficient management of budget funds in the medium-term. Existing strengths in this area, such as adoption of a comprehensive three year Fiscal Strategy on a rolling basis, preparation of independently-reviewed macro and fiscal forecast, and medium term estimates and ceilings, are not be built upon through their appropriate consideration and integration in budget years that follow. Allocations for transfers to sub-national levels are not determined in practice through an equitable rule-based system, although a regulation which prescribes such a system is in place.

✓Performance information and management. This largely relates to underdeveloped program budgeting practices, which lack substance in some key elements. While performance plans are prepared for budget beneficiaries, and the implementation is reported semi-annually and annually, there is limited analysis and follow-up with regard to the reported performance. Objective setting, and proper evaluation of results and indicators, results in sub-optimal allocation of resources as it does not factor in the information on performance into prioritizing budget activities in the following budget cycles.

✓ Management of public investments, public assets and fiscal risks. These functions are being developed, but registered weak performance in the assessed period. Implementing the recently introduced legislative framework for public investment management in the coming years could lead to improved selection and implementation of capital investments and increase their positive impact on the community and optimize the use of resources. Similarly, the register of non-financial assets is under implementation, and once fully functional it should improve the government's records of assets and enable results-oriented use and management. Continued development of fiscal risks monitoring would enable the government to respond to materialized fiscal risks and external shocks with reduced unfavorable impact on stability of public finances.

✓Accounting and Reporting. While there is no material concern about the accuracy of expenditures and revenues, preparation of the government's Balance Sheet without actual accrual standards being prescribed or applied undermines the quality of the reported information of the financial position. For example, the data on non-financial assets and arrears is not reliable. There are also gaps and inconsistencies in the accounting and reporting legislative framework. In-year budget execution reports are not published, while annual financial reports are published with delays.

Impact of PFM performance on budgetary and fiscal outcomes

Aggregate fiscal discipline. Overall efficient revenue administration contributes to improving fiscal discipline, but high levels of tax arrears negatively influence achieving planned levels of revenue. Annual budgets are reliable overall, with low to moderate deviations between the approved budget and its execution. This positively impacts fiscal discipline, as does the low extent of unreported operations of the central government. Budget documentation is also largely comprehensive and transparent. Budget execution is sound and hard controls allow spending by budget beneficiaries only within approved budget allocations, thus contributing to fiscal discipline. Commitments of the users of funding from RFZO (Health Insurance Fund), including all public health care institutions, are controlled against the annual contracts with the RFZO and the corresponding payments against invoice and RFZO advice on available funding to the Treasury Administration. All payments are executed through sub-accounts of the individual institution with the Treasury Administration. At the same time, the absence of centralized ex-ante controls that would effectively prevent budget beneficiaries from entering into legal commitments beyond the budget, generates downside risks for increased expenditure arrears should the currently favorable liquidity outlook reverse. While the Ministry of Finance monitors arrears regularly, there is a notable lack of publicly available information on trends in arrears management.

Unlike the annual budget, the procedures and processes which impact the medium-term horizon, demonstrate some deficiencies and can be detrimental to aggregate fiscal discipline. Macroeconomic and fiscal forecasting, fiscal policies and strategies, and medium-term estimates are duly prepared. Nevertheless there seem to be weak considerations of those when determining annual budget activities and allocations. Operationalization of the strategic priorities to budget programs and activities is not consistent and ad-hoc priorities frequently take precedence which in the long-term could undermine the stability of public finances and the environment for growth.

There was no formal and fully functional mechanism for monitoring of fiscal risks in the assessed period, which may result in additional unplanned budget expenditures which poses a risk to efficient fiscal management. There are shortcomings in asset management which prevent revenue maximization from renting, disposal, and overall management of assets. Public investment management demonstrated weaknesses, which can lead to selecting projects which face implementation delays and result in underspending of the capital budget, or projects which are poorly budgeted and experience cost overruns.

Strategic allocation of resources. There are many strategies, some of which are costed, however the linkage between strategic documents and composition and priorities of the annual budget and medium-term estimates is not always obvious. Annual deviations in functional composition expenditure increased in the period under assessment. Performance management and measurement of results of budget programs and activities are basic, which hinders effective monitoring and revising strategic priorities and their long-term impact based on performance.

Public investment management should be closely linked with strategic perspective of the budget, given that strategic dimension in selection of capital projects is crucial. Therefore weak public investment management does not support strategic allocation of resources. Considering the long-term perspective of strategic objectives, a weak medium-term budgetary framework does not create favorable conditions for proper planning of strategic activities. Similarly, improved monitoring and management of fiscal risks and arrears would ensure that there are no additional unplanned expenditures based on materialized fiscal risks or accumulated arrears, which could shrink the fiscal space for strategic allocations because of the need to address these ad-hoc issues.

A credible annual budget in terms of the level of total expenditures ensures strategic allocations are implemented as budgeted. Comprehensive and transparent budgets facilitate monitoring of budgeted and executed strategic allocations.

Therefore, while the system ensures funding for the annually budgeted activities and their implementation, the strategic objectives are not always operationalized through budget activities and ad-hoc expenditures may be prioritized instead.

Efficient service delivery. An overall reliable budget reduces the risk of reallocation of programs for service delivery to other expenditure categories, however attention should be paid to deviations in the composition of expenditures, in particular by functional classification. Transparent and comprehensive budget and reliable budget execution data facilitate appropriate monitoring of executed expenditures for service delivery. The overall well-performing revenue administration ensures that planned levels of revenue are collected and made available for service delivery without unnecessary delays. Likewise, predictability in resource allocation and cash management practices make the resources available on time and in line with operational plans of the service delivery units. Public procurement favors competitive practices and is not seen as a bottleneck to service delivery. In addition, the sound budget execution system and controls ensure that budget allocations intended for service delivery are executed in an orderly manner. Scrutiny exercised by the external audit, as well as the parliament, through performance auditing provide an additional layer of monitoring the expenditures related to service delivery. The internal audit function has been progressively strengthened in terms of number and training/certification of internal auditors with management response largely timely but still considered partial.

Underdeveloped program budgeting and performance management concepts and practices provide limited insights into the efficiency of service delivery. Appropriate measurement of achieved results, key performance indicators, outputs and outcomes for each budget program would be highly beneficial for more efficient service delivery in the medium to long term. Such performance information and analysis would enable corrective actions for the future budget cycles and provide valuable information for further improvements. While the performance plans are prepared for budgetary units, information on the performance achieved, resources received by service delivery units and performance evaluation are weak. The SAI is the only institution performing independent performance evaluations, but the number of performance audits is limited due to capacity constraints.

Performance changes from previous assessment

PFM performance registered an overall improvement compared to 2015. Thirteen out of 28 performance indicators kept the same rating, 11 indicators registered improved scores due to improved performance, and only 3 indicators showed deteriorated scores. One indicator, related to unreported government operations was unrated in 2015, while it was rated with the highest score in 2020.

The main improvements between PEFA assessments in 2015 and 2020 relate to monitoring of autonomous government agencies and public enterprises; sector strategies are prepared and costed for higher number of sectors; revenue administration saw an overall improvement; budget execution registered improvements in predictability of available of funds for budget users during a year, as well as instituted and applied internal controls; the budget was rated higher for credibility, comprehensiveness of the budget documentation, compliance with the budget calendar, and information on donor funded projects included in the budget; public procurement was improved in the area of public access to procurement information; as well as internal audit, external audit coverage and legislative scrutiny. Transparency and objectivity for transfers to sub-national level of the government was downgraded, as well as monitoring of arrears.

Given the performance changes had an upward tendency, they impacted the fiscal and budgetary outcomes in a positive way. More reliable budgeted expenditures and revenue enhance aggregate fiscal discipline. At the same time, credible budgets also ensure that allocations for strategic purposes are properly planned and executed, without the risk of poor budgeting resulting in reallocation of resources to less strategic, unplanned and ad-hoc activities. More effective internal controls contribute to a sound and reliable budget execution. Strengthened legislative scrutiny creates an accountable environment favorable to aligning budget priorities with strategic objectives. Improved efficiency of revenue administration ensures the availability of resources for undertaking strategic projects. Reliable budgets, sound budget execution, and efficient revenue administration likewise ensure that resources allocated for service delivery are properly planned, made available, and executed without disruptions such as reallocation to other priorities. Quality findings by internal audit also have a positive impact by integrating their recommendations in order to bolster efficiency of service delivery, despite the low overall rate of value for money audits conducted.