Bosnia and Herzegovina District Brčko 2023

Executive Summary

• Purpose and management

This PEFA assessment provides a snapshot of PFM system performance across the different government levels of BiH as specified in the country’s Constitution. It is carried out following the PEFA assessment performed in 2014 by the World Bank. The assessment was completed by a team of international and local PFM consultants under a technical assistance project funded and managed by the EU Delegation in BiH. Ministries of Finance of the four levels government involved in the assessment, together with other relevant stakeholders, were the main beneficiaries of the assessment. Oversight team was composed of representatives of the Ministries of Finance, EUD, World Bank, IMF, SECO and UNDP. The purpose of the assessment is to fullfill the following objectives that have been duly discussed and agreed with the key partners (i.e., Ministries of Finance of BiH, FBiH and RS and Directorate for Finance of BD):

- provide a baseline assessment using the 2016 Framework and update on the progress since the last (2014) PEFA assessment,

- inform and contribute to more effective implementation and subsequent adjustments of the 2021-2025 PFM Reform Strategies across all government levels as well as the Comprehensive PFM Strategy for BiH,

- enable the governments to identify reform priorities, time their implementation and allocate resources in the most efficient way,

- provide the basis for PFM capacity development initiatives in various segments of PFM systems.

• Main strengths and weaknesses of the PFM systems in Bosnia and Herzegovina

The assessment has identified the following main strengths of the country’s PFM system:

Expenditure management - Expenditure management is performing well and could be considered as the main strong point of the country’s PFM system. The upstream expenditure management is primarily based on relatively strong macro-economic and fiscal forecasting functions which are provided by Directorate for Economic Planning and the Macroeconomic Analysis Unit of the Indirect Tax Authority. Moreover, the system exhibits a solid level of fiscal discipline which is manifest across all four levels of government as confirmed by relatively small deviations between the executed and the approved budgets at the aggregate level. In-year reallocations between the main budget categories across all levels, however, result in higher deviations and show only basic performance for the fiscal years covered by the assessment.

Budget preparation processes in BiH across government levels function by and large according to relevant regulatory prerequisites and institutional arrangements. For example, budget preparation calendar is embedded in the relevant legislation for each level of government in BiH and is largely complied with except for the Institutions of BiH where political stalemate has resulted in delays in budget adoption in recent years. There is space for improvement, which requires only certain amount of regulatory finetuning and capacity development, depending on the particular issue in question.

Debt management - Legislated debt service limits prevent rampant debt financing and have a further effect of strengthening overall fiscal discipline, albeit with inherent systemic weaknesses as discussed below. Debt servicing forecasts are regarded as mostly reliable and are well integrated in the budget planning process. Moreover, debt management strategies are comprehensive and credible documents in the sense that they encompass all the essential elements including assessment of broader macroeconomic context, cost and risks associated with the implementation of debt management strategy, all of which are needed to ensure that both the level and rate of growth in public debt are sustainable and can be serviced under a variety of circumstances.

External audit - All levels of government have strong external audit functions in place, with the only difference being the fact that external audit follow up by the executive is more pronounced at the level of Brčko District and RS as compared to the level of FBiH and BiH Institutions. One notable trait about the external audit function in BiH is the fact that it has benefited from a direct bilateral program of technical assistance (via Swedish National Audit Office) which has been provided to the SAIs across the levels of government on a continuous basis over the span of more than 20 years.

The following were assessed as areas for continued reforms and further improvements:

Strategic targeting of public budgets - This was a noted issue in the context of previous assessment and continues to be the weakest performing feature of BiH PFM system a decade later. Budgets continue to largely reflect planned legal commitments within the available budget envelope rather than serving as a tool to strategically direct resources towards the achievement of social and economic and development objectives. In spite of its importance, an effective strategic planning and prioritization system has not been fully established in Bosnia and Herzegovina. Some progress has been made with the adoption of regulatory changes across all government levels, however the declarations made in adopted strategic documents have yet to find their way into actual implementation.

Result-based (performance driven) allocation of public funds - This is another key issue which the governments have not been able to address effectively since the last PEFA assessment. Namely, government policies across different levels and sectors in BiH are designed, planned, funded and delivered with insufficient regard for efficiency and impact of such interventions. Performance information is not used prior to policy formulation (i.e baselines), during and following their implementation, therefore increasing the likelihood of waste and mismanagement of scarce budget funds. This remains to be the case both at the highest level of executive and within individual line ministries and other spending agencies.

Parliamentary scrutiny of budgets and fiscal strategy - Parliaments continue to exhibit weak involvement in the budget preparation process which is primarily due to a still remaining weak capacity for systematic budget analysis and also due to delayed submissions of budget proposals by the government. Parliaments are often not given enough time to properly scrutinize government budget whereas they are adopted following a “fast track” procedure, which limits the scope for parliamentary scrutiny and public discussion. Although there are technical services within the Parliaments in BiH that provide support to Committees, the capacity for independent research and provision of information is relatively weak. Similarly, the strategic framework for fiscal management exhibits weaknesses across the country. Fiscal strategies are adopted in different forms; however they do not contain sufficient information on the fiscal impact of policy proposals while fiscal outcomes reports have yet to be instituted.

Management of fiscal risks and public investment management - Both of these functions are at the verym basic level of performance across all government levels. Set-up for monitoring of financial performance of public enterprises is still in the inception although institutional structures exist. Operational issues mainly pertain to a lack of effective data exchange and suboptimal capacities to handle and process the information at hand. Coverage of public enterprises is very much incomplete and does not contribute to the assessment of the implied fiscal risks. None of the government levels provide a comprehensive assessment of contingent liabilities in their financial reports, except for non-systematic reference to certain types of these risks which is not adequately put into the perspective of potential budgetary implications. The effectiveness of public investment management is hindered by structural weaknesses. None of the government levels in BiH have guidelines in place for the preparation of the economic analysis of investment projects. While a certain number of capital projects do have such analysis, the selection process is based on criteria that are either not publicly available or detached from the budget process (i.e. financing). Finally, monitoring of investment implementation is not done in an articulated and comprehensive manner.

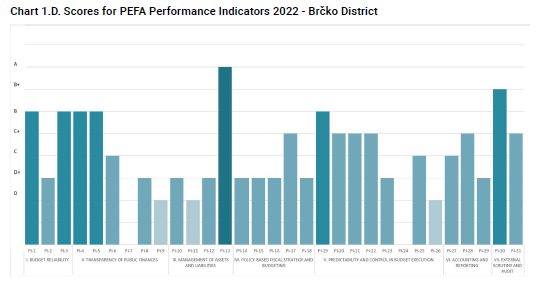

Performance for the District Brčko individual government, as reflected in the scores assigned as per PEFA criteria, is summarized in the chart below:

• Impact of PFM performance on budgetary and fiscal outcomes

Aggregate fiscal discipline

Aggregate fiscal discipline aims to align the levels of revenue and expenditures without creating significant fiscal deficits which could jeopardize fiscal sustainability and spending within the available fiscal space. The reliability of expenditure and revenue at aggregate level contributes positively to aggregate fiscal discipline across all four levels of government in BiH. While budget classification systems in place remains somewhat a challenge, budget documentation is comprehensive and can support quality budget decisions and service delivery.

The extent to which each aspect of asset and liability management contributes to fiscal discipline varies across BiH. There is no adequate structure for monitoring and reporting of fiscal risks, especially in the area of public corporations, which clearly undermines fiscal discipline. On the other hand, the management of debt performs along the principles of good practice and has positive bearing on fiscal discipline. Public asset management would benefit from further development across all four levels, especially in the domain of transparency of asset disposal.

Medium-term perspectives in planning and budgeting and program budget are under development and more progress has to be made to consolidate the results of reforms made so far before the process continues. Macro-fiscal forecasts are prepared as part of the budget documentation, but the medium-term expenditure framework (MTEF) is not sufficiently aligned with strategic plans which impedes discipline and prevents the budget framework to provide for maximization of the long-term impact of government policies. There is no established practice of preparing and delivering reports on fiscal outcomes against the fiscal strategic framework.

Strategic allocation of resources

Budget preparation process is structured to allow for efficient resource allocation while in-year budget execution reports provide enough reliable information to assess its effectiveness. The predictability of in year resource allocation enables consistence in implementation of priorities set forth by the budget. Also, payroll controls are sufficiently effective and do not allow for ad hoc increase in payroll costs or generation of wage related arrears.

However, strategic documents across the four levels of government are only partially translated to the budget as the process of strategic planning is not well integrated with the budget formulation process. This is also a consequence of the early stage of development of the program budget framework and lack of performance measurement of government programs, projects and activities. Public investment management framework is underdeveloped. Specifically, the lack of clear and consistently applied project prioritization and selection criteria undermines efficiency of resource allocation. On the other hand, recording and reporting of the incurred debt generally follows the best practice and positively affects the ability to strategically allocate resources.

Efficient service delivery

In-year resource allocation scheme entailing consolidation of balances and cash management provide for smooth implementation of the budget. With some variation, key fiscal information is prepared and made available to the public throughout the budget preparation and budget execution process. Revenues are collected and administered through an efficient TSA thus making the funds necessary for implementation of budget policies available without delays. Also, public procurement structures in place seem to enable delivery of works and services envisaged by the governments in BiH, albeit with significant inefficiencies which are embedded in the system especially with respect to a slow and encumbering procurement review processes and the fact that only about 65% of contracts are awarded through open competition. On the other hand, significant deviations in expenditure composition together with lack of information on performance of service delivery units is likely to undermine effectiveness of government policies and the ability to monitor its efficiency. Underdeveloped program budgeting and performance management concepts and practices provide limited insights into the efficiency of service delivery. Appropriate measurement of achieved results, key performance indicators, outputs and outcomes for each budget program would be highly beneficial for more efficient service delivery in the medium to long term. Such performance information and analysis would enable corrective actions for the future budget cycles and provide valuable information for further improvements. External audit function is well established across the country providing for efficient delivery of services envisaged by the budget, although more can be done to ensure implementation of follow-up recommendations. Capacity of the SAI for performance audit is increasing but still has limited coverage.

• Performance changes since the previous PEFA assessment (2014, using the 2011 PEFA methodology)

With certain variations, there has been an overall improvement in PFM performance across all government levels in BiH compared to the previous PEFA assessment conducted in 2014. PFM performance at the level of BiH Institutions maintained relatively unchanged performance compared to 2014 - from the 28 performance indicators reassessed using the 2011 Framework, 12 indicators maintained the same rating (43%), 7 indicators recorded improved results (25%), and 6 indicators showed lower scores (21%). Of the three remaining indicators, two have not been rated while one is not applicable (PI-7).

In FBiH, there has been a moderate improvement in performance whereas out of the 28 performance indicators reassessed under the 2011 Framework, 12 indicators maintained the same rating (43%), 6 indicators recorded improved results (21%), and 4 indicators showed worsening results (14%). In RS, the PFM performance since the previous assessment improved the functions and processes in 12 (42%) of the performance indicators, 4 indicators (14%) performed worse while the 9 (32%) indicators kept the same score.

Brčko District’s PFM performance improved in the sense that there were more indicators with improved scores (11 or 39%) than those with deteriorated assessment (4 or 14%). The remaining 12 indicators kept the same score as in 2014 PEFA assessment.

There are solid improvements in performance registered across levels with respect to comprehensiveness and transparency of public finances, whilst the improvement is most notable in the case of RS. Main improvements in the case of BiH Institutions relate to improved budget classification, while the FBiH significantly strengthened the comprehensiveness of information provided in its budget documentation. Multi-year perspective in fiscal planning, expenditure policy and budgeting has registered modest overall improvement across all levels primarily due to improved debt management related practices. Another notable improvement relates to the performance of the Indirect Tax Authority (ITA) with respect to improved access to comprehensive, user-friendly, and up-to-date information on tax liabilities and the fact that there are administrative procedures for major taxes, including taxpayer education campaigns.

Internal controls have registered a solid improvement at the level of BiH Institutions and FBiH. RS has also seen a notable improvement in expenditure commitment controls due to improved procedural framework and subsequent practices which limit commitments to actual cash availability and approved budget allocations. Also, there has been an increase in the coverage and quality of the internal control function across the board, with the exception of BD which is lagging behind. Effectiveness of control of non salary related expenditure has seen notable improvement in FBiH, BiH Institutions and RS. Accounting and financial reporting in RS is now improved with application of IPSAS while other government levels are still making efforts to apply these standards. Financial reports for budgetary central government are prepared annually and are comparable with the approved budget. They contain full information on revenue, expenditure, financial and tangible assets, liabilities, and long-term obligations, and are supported by a reconciled cash flow statement. Budget calendar is generally adhered to while there is a deterioration in the score at the level of BiH Institutions due to political disagreements and the fact that in the last five years, the parliamentary committees for budget and policy analysis did not have adequate time to undertake detailed analysis/ budget hearings due to imposition of the fast-track budget adoption procedure. Other areas that proved weaker than before at the level of BiH Institutions include public access to fiscal information, effectiveness in collection of tax payments due decreased debt collection rate) and quality and timeliness of in-year budget reports. Notable performance deterioration for the level of FBiH have been observed in the fields of the availability of information on resources received by service delivery units and quality and timeliness of annual financial statements, while RS worsened its performance with regard to legislative scrutiny of external audit reports and expenditure composition outturn. Finally, compared to previous assessment, the performance of the PFM system in Brčko District is downgraded in the areas of comprehensiveness of the government financial reports and budget classification where only partial application of GFS methodology was observed.

Performance with respect to aggregate expenditure out-turns has been maintained across levels with relatively marginal deterioration with respect to the composition of expenditure out-turns in the case of FBiH and RS. On the other hand oversight of aggregate fiscal risk from other public sector entities have remained as week as it was during 2014 PEFA assessment, hence it continues to be a prominent issue of concern from the aspect of sustainability public finances in the near to medium term, especially in the case of FBiH. Performance with respect to external scrutiny and audit have remained the same on balance. The RS has registered an improvement with respect to better managerial response and follow up to external audit recommendations on the one hand while legislative scrutiny of audit reports has deteriorated. In FBiH the score is largely affected by the fact that only a small portion of the recommendations by the external audit are fully implemented.