Ukraine 2019

1. The main purpose of the 2019 PEFA assessment is to provide the Government of Ukraine with an objective and up-to-date diagnostic of the national-level public financial management performance based on the latest internationally recognized PEFA methodology. The 2019 PEFA is an assessment of the quality of the Ukrainian PFM system and monitors the results achieved through PFM reforms undertaken since the 2015 PEFA assessment. More specifically, the PEFA assessment measures which processes and institutions contribute to the achievement of desirable budget outcomes, aggregate fiscal discipline, strategic allocation of resources, and efficient service.

2. The assessment covers the central government. It also includes the Ministry of Economy as the authorized body for Procurement Service, State Audit Service, Budget Committee of the Verkhovna Rada of Ukraine (Parliament), State Fiscal Service of Ukraine (revenue administration), and Accounting Chamber of Ukraine (supreme audit body). It also assesses aspects of the three extrabudgetary funds and qualifying state-owned enterprises in terms of the relevant indicators. A substantial number of government officials participated in the assessment.

3. Since the last PEFA assessment, overall reforms across the Ukrainian PFM system have proceeded gradually and progressively.

Specifically, the Government has made progress in: (i) implementing mediumterm budget planning; (ii) integration of International Public Sector Accounting Standards (IPSAS) into Ukraine’s statutory framework and the adoption of the 2025 public sector accounting (PSA) strategy; (iii) improving macroeconomic and budget forecasting tools; (iv) increasing transparency in public financial management through the introduction of an open budget portal; (v) fiscal risk management, and (vi) gradually introducing a gender-oriented approach to budgeting.

4. The Ministry of Finance is leading implementation and measuring progress of the PFM reform based on the PEFA-based PFM Reform Strategy. It has expressed its interest to update that strategy based on the 2019 PEFA findings and subsequent recommendations. The 2017-2020 PFM Reform Strategy approved at the beginning of 2017 is aimed at establishing a modern and efficient PFM system that provides quality public services through the efficient accumulation of resources that fund medium- and long-term development priorities. The PFM Reform Strategy focuses on four priority directions: (i) adherence to general budget and taxation discipline in the medium-term; (ii) increasing the efficiency of reallocating resources when setting state policy; (iii) ensuring the efficient execution of the State Budget; and (iv) increasing transparency and accounting in public financial management.

5. Under the MoF’s coordination, the 2019 PEFA assessment is led and undertaken by the World Bank within the Parallel EC-World Bank Partnership Program for the Reform of Public Administration and Finances (EURoPAF). Some development partners (SIDA and US Treasury) participated in the assessment. The assessment covered fiscal years 2016 to 2018 and was performed in April/June 2019. The cut-off date was June 29, 2019.

6. Ukraine is an eastern European country with a population of about 42 million. The country has experienced acute political, security, and economic challenges during the past five years. Since the “Maidan” uprising in February 2014 that led to the ousting of the President, the country has witnessed several momentous events, including the outbreak of conflict in eastern Ukraine and presidential, parliamentary, and local elections. Ukraine’s relatively small and open economy has significant economic potential. It possesses a good agricultural land base, minerals and raw materials, and has a manufacturing base supported by an educated workforce and an expanding internal market. After experiencing a deep economic crisis in 2014- 2015, economic growth resumed in the last few years at a rate of 2.4 percent in 2016, 2.5 percent in 2017, and 3.3 percent in 2018.

7. Overall there are positive features in the PFM system in Ukraine. The production of accurate total revenue projections has ensured that the budget is spent as planned with few arrears due to strong commitment control with virement and supplementary budgets managed well. Ukraine has an impressive array of information regarding the finances of budgetary central government. The Chart of Accounts, which underpins budget preparation, execution and reporting, is comprehensive but still requires work to fully integrate the budget and reporting elements. Information is included in the budget on a timely basis. Apart from the three social security funds, there is complete data regarding operations for public bodies in the budget documentation. However, these funds are significant in size, but they do produce annual budget and financial statements outside of the overall government reports. A large part of transfers to subnational governments mostly related to social protection, health and education services is transparently determined, while the Cabinet allocates some other transfers between local budgets after the approval of budgets during the fiscal year; sometimes transfers happen in the last months of the year, which may lead to ineffective use of budgeted funds. Mentioned is mostly applied to capital transfers which amounted 48.3 percent of the total amount of public capital investments financed by the State Budget in 2018, 56.1 percent in 2019 and 54.8 percent in 2020 year. Information on plans and achievements in service delivery performance is strong and there is good tracking of resources to service delivery units reflecting the strong accounting and reporting system. Public access to fiscal information is strong, including a citizen’s (summary) budget which was produced for the first time as part of the most recent budget.

8. Management of assets and liabilities shows uneven performance. A comprehensive process is lacking in management of the public investment program. There is reporting of fiscal risks from state owned enterprises and local government but greater auditing of both sets of financial statements is required to make improvements. Public asset management is good but could be improved with better information on the usage and the age of non-financial assets. Debt recording management and approval are strong, but the debt management strategy lacks complete borrowing targets. The public procurement system is good, and this reflects the ProZorro electronic procurement system which has been recognized internationally and has received several awards. However, the share of competitive base electronic auctions could be increased.

The public investment management lacks strategic and transparent allocation of resources and investment project costing. Selection of the major investment project is carried out according to the established selection procedures based on the standard criteria, but budget funds, including inert budgetary transfers, are dispersed across medium or small size projects, and spending for projects which fall into the budget beyond competitive selection nearly double properly selected investments.

9. Some limited progress has been made towards a comprehensive medium-term expenditure framework. There is good information on the specification and evaluation of key performance indicators.

However, this is not linked in a medium-term approach to expenditure budgeting as the budget is presented for the up-coming year only. The overall fiscal strategy only focuses on the budget year but does contain objectives to be achieved and there is no reporting against outcomes. There are no hard ceilings for budget preparation and there are only some costed sector strategies for budget formulation. The budget calendar does not provide adequate time to prepare individual budgets. The legislature only considers fiscal policies and aggregates for the budget year and not the medium-term.

10. The State Fiscal Service of Ukraine was responsible for revenue collection at the time of the assessment. The taxation system is based on comprehensive legislation providing information on the tax liabilities of taxpayers with respect to obligation and a redress system that guarantees independence from the administration. A comprehensive risk-based approach to administering revenues is lacking which impinges on audit planning. Revenue collected is relatively well managed in terms of the flow of funds to the Treasury and recording of transactions.

11. The consolidation of cash balances in the Treasury Single Account at the National Bank of Ukraine is made on a daily basis. The Treasury forecasts the annual cash flow broken down by month and updates the projections monthly. Monthly forecasts with daily cash flow estimates are also developed, however that forecast is limited to the calendar month and does not project beyond that month. Spending units can commit funds up to the value of their annual budget allocations and make payments up to the value of their monthly apportionment limits.

12. Overall the payroll system requires strengthening. Each budgetary agency is responsible for maintaining its own payroll accounting system but information on employees and remuneration is not reconciled. Changes to the employee information and salary are made within three months following clear and detailed rules, and procedures provide a clear audit trail. There are regular inspections that monitor the eligibility, timeliness and completeness of salary payments but full payroll audits are conducted on average only once every three years.

13. Internal controls on non-salary expenditure show effective commitment controls and compliance with payment rules and procedures but segregation of duties with clear responsibilities could be improved.

The positive achievements are ensured by the management information system (“E-Treasury”) that supports the Treasury Single Account (TSA). The internal audit function is being developed and activities are primarily focused on compliance. Harmonizing systems and processes needs to be expanded in terms of effective coverage. Good implementation of internal audit recommendations ensures the effectiveness of the audit program.

14. Accounts reconciliation and financial data integrity are areas of strength. Data integrity is good as access and changes to records are restricted and recorded with a sufficient audit trail. However, the system lacks a dedicated operational unit. With respect to in-year budget reports, coverage and classification of data allows for direct comparison to the original budget. There are both monthly and quarterly budget execution reports at the payment stage and there are no material concerns regarding data accuracy. The annual financial statements include complete information on assets, liabilities (including long-term), revenue, expenditure, and reconciled cash statements and are submitted for external audit within three months. The national public sector accounting standards are largely consistent with the international standards. However, the differences between applicable national provisions and IPSAS are not presented. External audit is an area of significant strength. The financial statements are audited using standards based on International Standards of Supreme Audit Institutions (ISSAI). The content of audit completion certificates as well as recommendations and auditees’ reports on the elimination of detected shortcomings and implementation of audit recommendations are all published. Legislative scrutiny of audit reports is timely and transparent. However, the hearing of audit findings and follow up on audit recommendations could be improved.

Aggregate Fiscal Discipline

15. Aggregate fiscal discipline is achieved due to control over spending during budget execution, as well as relatively realistic revenue forecasts. Revenue administration ensures that revenues are efficiently collected, but the relative weaknesses in applying risk-based approaches to enforcement undermine overall discipline. The planned budget, on an aggregate basis, is not circumvented using virement and supplementary budgets. Treasury operations and cash management enables expenditures to be managed within the available resources. Control of contractual commitments is effective and has removed expenditure arrears. The external audit function enhances fiscal discipline.

Strategic allocation of resources

16. The Chart of Accounts caters to a multi-dimensional analysis of expenditure. However, there is an absence of a medium-term perspective in expenditure budgeting. Performance indicators are specified, and there is assessment and independent evaluation of performance achievement. Costed strategic plans, aligned to the budget process, are generally lacking and wider coverage would assist in the development of performance plans. There is an emphasis on overall fiscal forecasting, but this does not extend to a multi-year fiscal strategy to assist in resource allocation. Better management of investment would improve the strategic allocation of resources. Better allocation would ensure that the recurrent cost implication of investment is better factored into the budget process and that investments are also subjected to economic analysis and selected to generate the best return.

Efficient use of resources for service delivery

17. The strength in the procurement process is good and impacts efficiency in service delivery though it may be possible to have more contracts based on competitive bidding. Weakness in the payroll system particularly with the integration of payroll and personnel systems may mean that staff are not used effectively. The strengths in the accountability mechanisms make external audits effective as counter checks on inefficient use of resources. The annual production of consolidated annual financial statements ensures the timely impact of audits. The monthly (and quarterly) budget execution reports also ensure that there is a well-timed usage relating to the planned budget. Publishing of performance targets and outcomes and their achievements supports the efficient use of resources in service delivery units as does the evaluation of performance.

Performance changes since the previous assessment

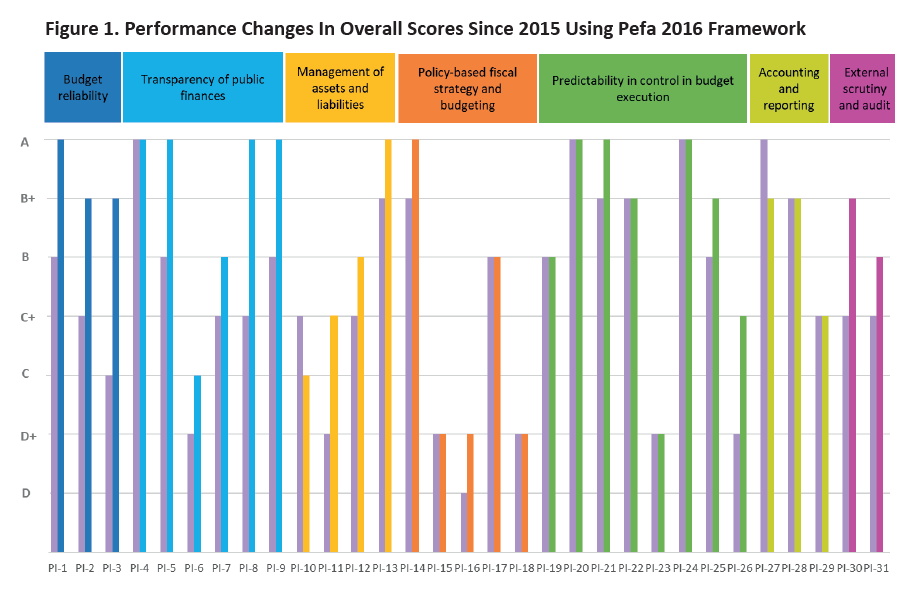

18. The 2019 PEFA and the previous PEFA assessments were carried out using the 2016 methodology so it is possible to compare both sets of scores directly. 29 of the 94 dimensions over 21 of the 31 indicators improved. This is a significant achievement and is testament to the hard work in implementing the PFM reform program. The score in 4 dimensions in 4 indicators declined. The changes in the indicator scores are presented in Figure 1.